As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the testing & diagnostics services industry, including Labcorp (NYSE: LH) and its peers.

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

The 5 testing & diagnostics services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.9%.

Thankfully, share prices of the companies have been resilient as they are up 7.1% on average since the latest earnings results.

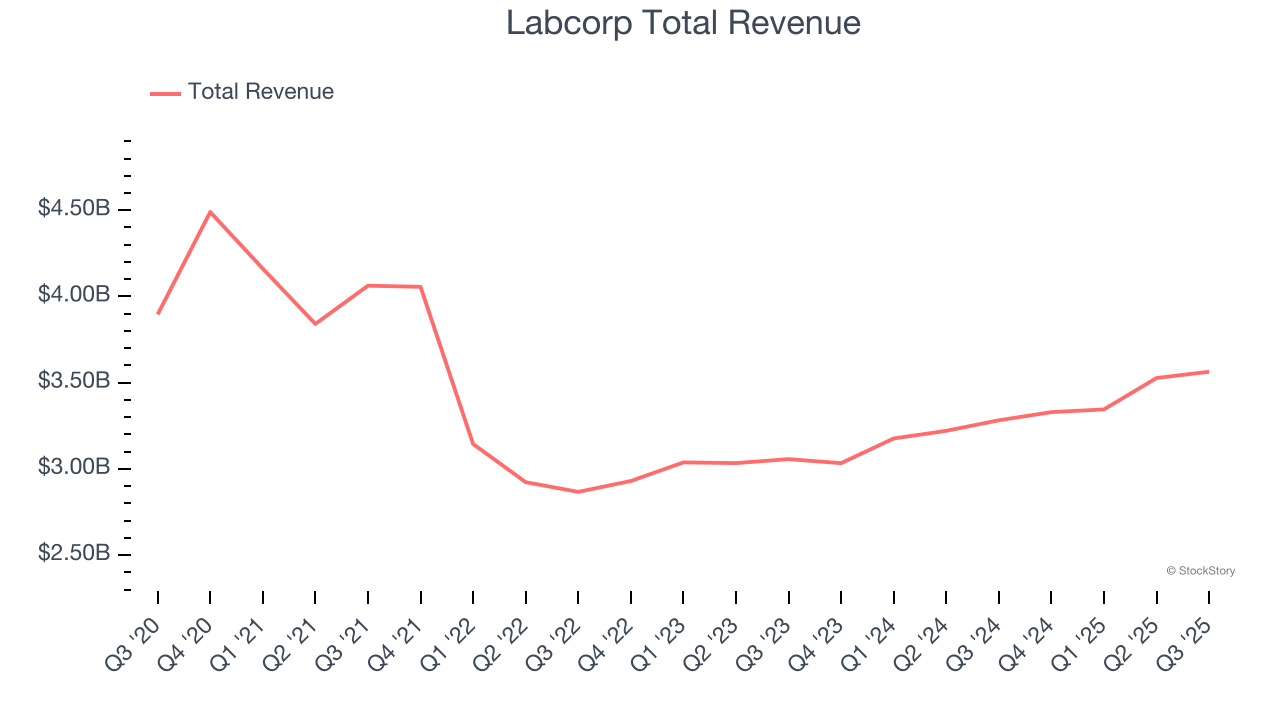

Weakest Q3: Labcorp (NYSE: LH)

With over 600 million tests performed annually and involvement in 90% of FDA-approved drugs in 2023, Labcorp (NYSE: LH) provides laboratory testing services and drug development solutions to doctors, hospitals, pharmaceutical companies, and patients worldwide.

Labcorp reported revenues of $3.56 billion, up 8.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a narrow beat of analysts’ organic revenue estimates.

"Labcorp's third-quarter performance reflects continued momentum in our Diagnostics and Central Laboratory businesses, resulting in strong revenue growth and margin improvement," said Adam Schechter, Chairman and CEO of Labcorp.

Labcorp delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Unsurprisingly, the stock is down 2.6% since reporting and currently trades at $268.41.

Is now the time to buy Labcorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

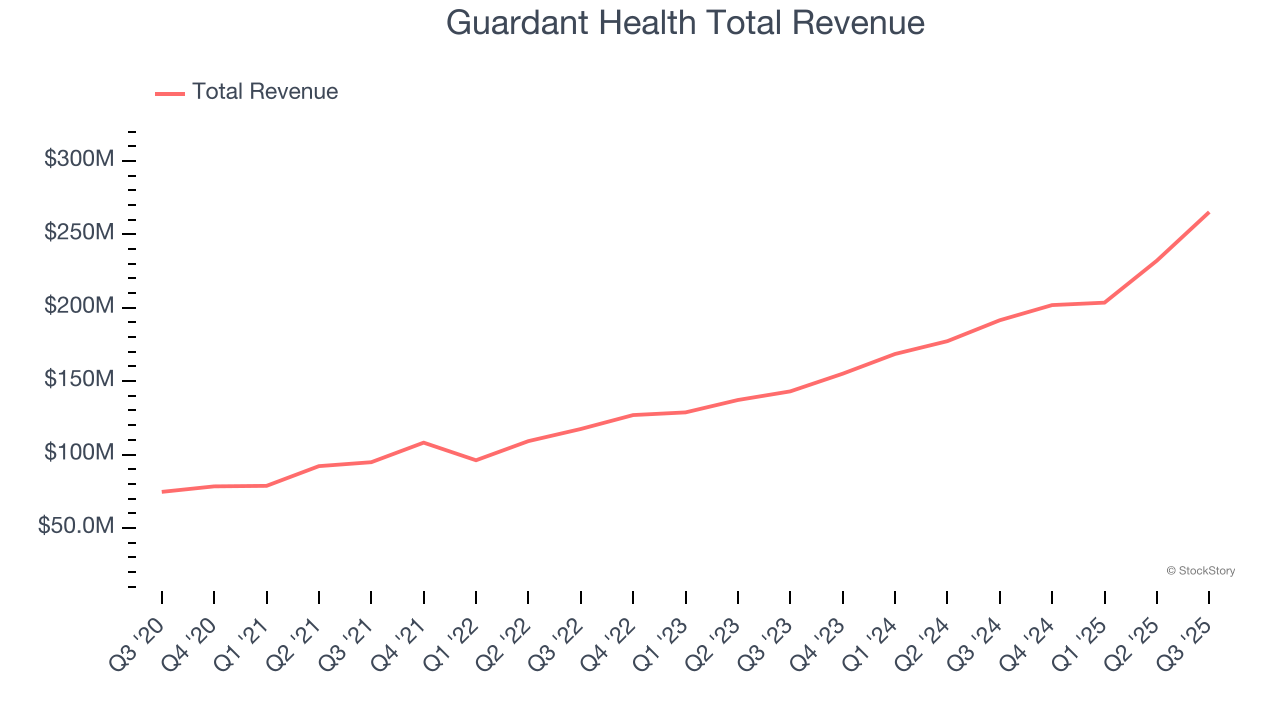

Best Q3: Guardant Health (NASDAQ: GH)

Pioneering the field of "liquid biopsy" with technology that can identify cancer-specific genetic mutations from a simple blood draw, Guardant Health (NASDAQ: GH) develops blood tests that detect and monitor cancer by analyzing tumor DNA in the bloodstream, helping doctors make treatment decisions without invasive biopsies.

Guardant Health reported revenues of $265.2 million, up 38.5% year on year, outperforming analysts’ expectations by 12.6%. The business had an incredible quarter with an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Guardant Health delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 36.1% since reporting. It currently trades at $98.36.

Is now the time to buy Guardant Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

RadNet (NASDAQ: RDNT)

With over 350 imaging facilities across seven states and a growing artificial intelligence division, RadNet (NASDAQ: RDNT) operates a network of outpatient diagnostic imaging centers across the United States, offering services like MRI, CT scans, PET scans, mammography, and X-rays.

RadNet reported revenues of $522.9 million, up 13.4% year on year, exceeding analysts’ expectations by 6.3%. It was a satisfactory quarter as it also posted a solid beat of analysts’ revenue estimates but a significant miss of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $78.57.

Read our full analysis of RadNet’s results here.

NeoGenomics (NASDAQ: NEO)

Operating a network of CAP-accredited and CLIA-certified laboratories across the United States and United Kingdom, NeoGenomics (NASDAQ: NEO) provides specialized cancer diagnostic testing services, including genetic analysis, molecular testing, and pathology consultation for oncologists and healthcare providers.

NeoGenomics reported revenues of $187.8 million, up 11.9% year on year. This result surpassed analysts’ expectations by 2.1%. Overall, it was a strong quarter as it also produced EPS in line with analysts’ estimates and an impressive beat of analysts’ revenue estimates.

NeoGenomics had the weakest full-year guidance update among its peers. The stock is up 2.7% since reporting and currently trades at $10.42.

Read our full, actionable report on NeoGenomics here, it’s free for active Edge members.

Quest (NYSE: DGX)

Processing approximately one-third of the adult U.S. population's lab tests annually, Quest Diagnostics (NYSE: DGX) provides laboratory testing and diagnostic information services to patients, physicians, hospitals, and other healthcare providers across the United States.

Quest reported revenues of $2.82 billion, up 13.2% year on year. This number topped analysts’ expectations by 3.3%. It was a strong quarter as it also put up a solid beat of analysts’ revenue estimates and full-year revenue guidance slightly topping analysts’ expectations.

Quest scored the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $188.85.

Read our full, actionable report on Quest here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.