Specialty insurance provider Fidelis Insurance (NYSE: FIHL) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 5% year on year to $651.9 million. Its non-GAAP profit of $1.21 per share was 1% above analysts’ consensus estimates.

Is now the time to buy Fidelis Insurance? Find out by accessing our full research report, it’s free for active Edge members.

Fidelis Insurance (FIHL) Q3 CY2025 Highlights:

Dan Burrows, Group Chief Executive Officer of Fidelis Insurance Group, commented: “We delivered outstanding results in the third quarter, with our 79.0% combined ratio representing our best quarterly performance as a publicly traded company and an excellent annualized Operating ROAE of 21.4%.

Company Overview

Founded in Bermuda in 2014 and designed to adapt nimbly to evolving market conditions, Fidelis Insurance (NYSE: FIHL) is a global specialty insurer and reinsurer that provides customized coverage across property, specialty, and bespoke risk solutions.

Revenue Growth

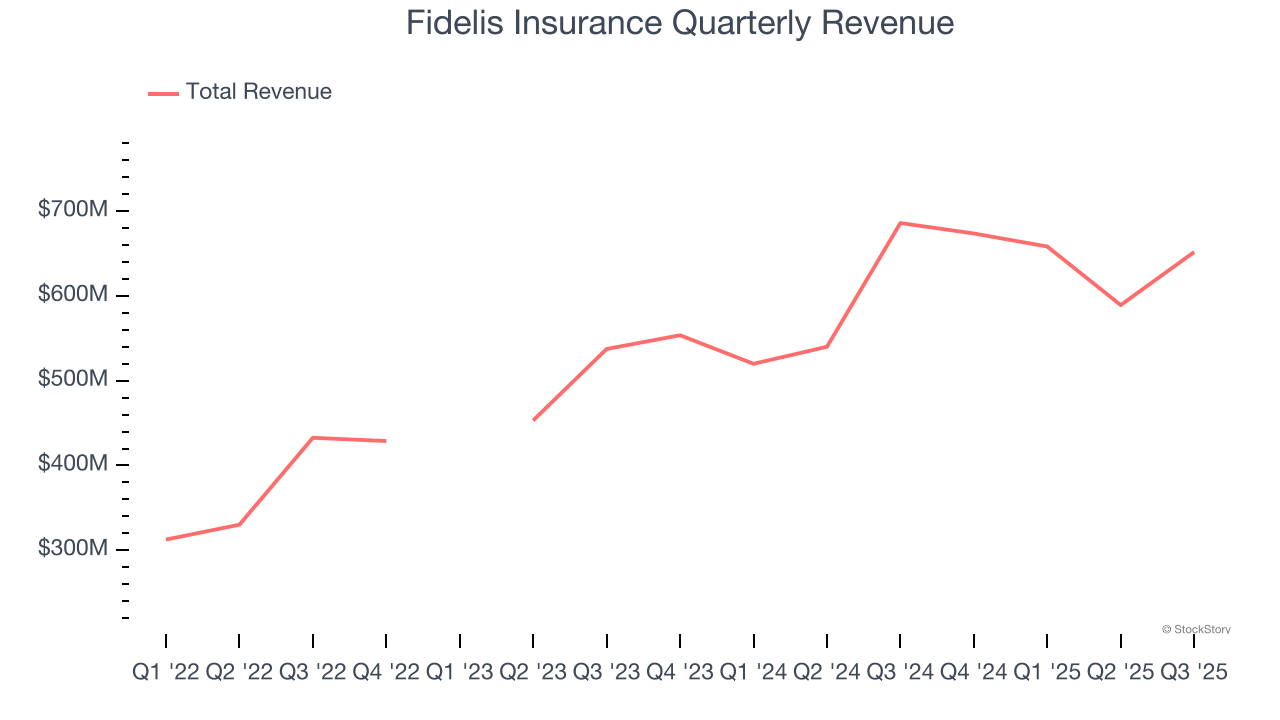

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Fidelis Insurance’s annualized revenue growth rate of 16.1% over the last two years was incredible for an insurance business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.This quarter, Fidelis Insurance missed Wall Street’s estimates and reported a rather uninspiring 5% year-on-year revenue decline, generating $651.9 million of revenue.

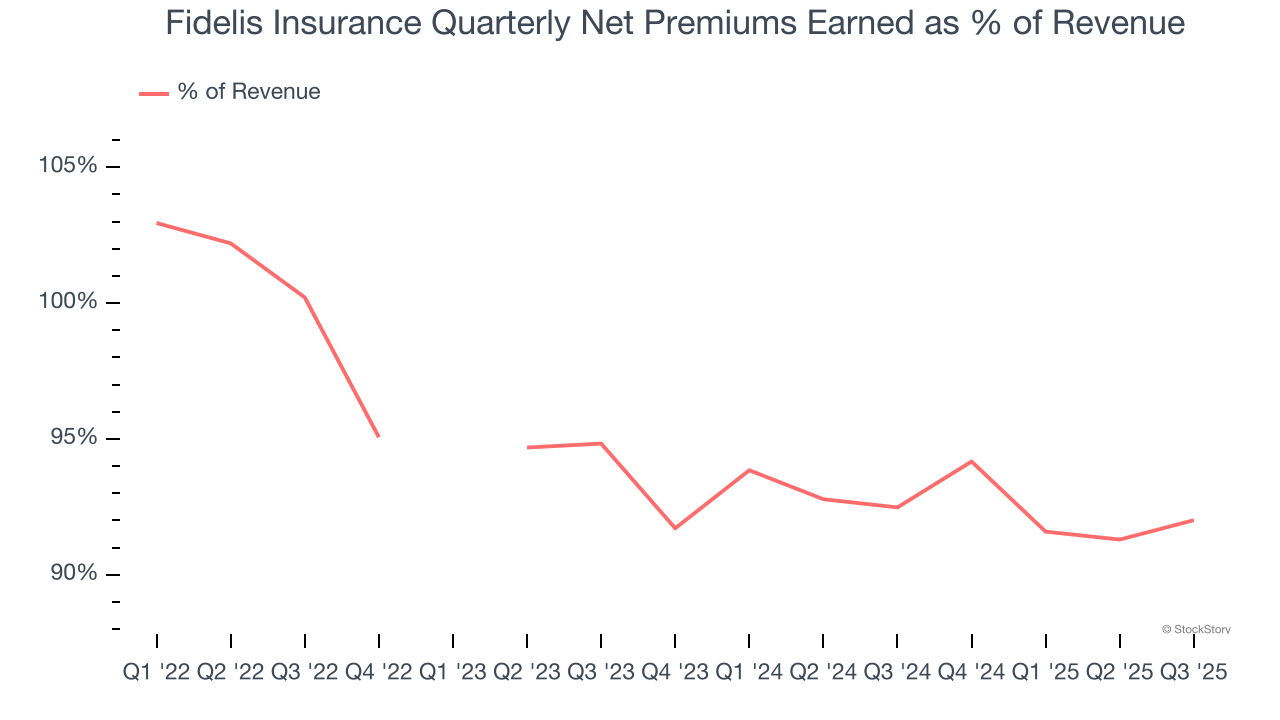

Net premiums earned made up 77.8% of the company’s total revenue during the last four years, meaning insurance operations are Fidelis Insurance’s largest source of revenue.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Book Value Per Share (BVPS)

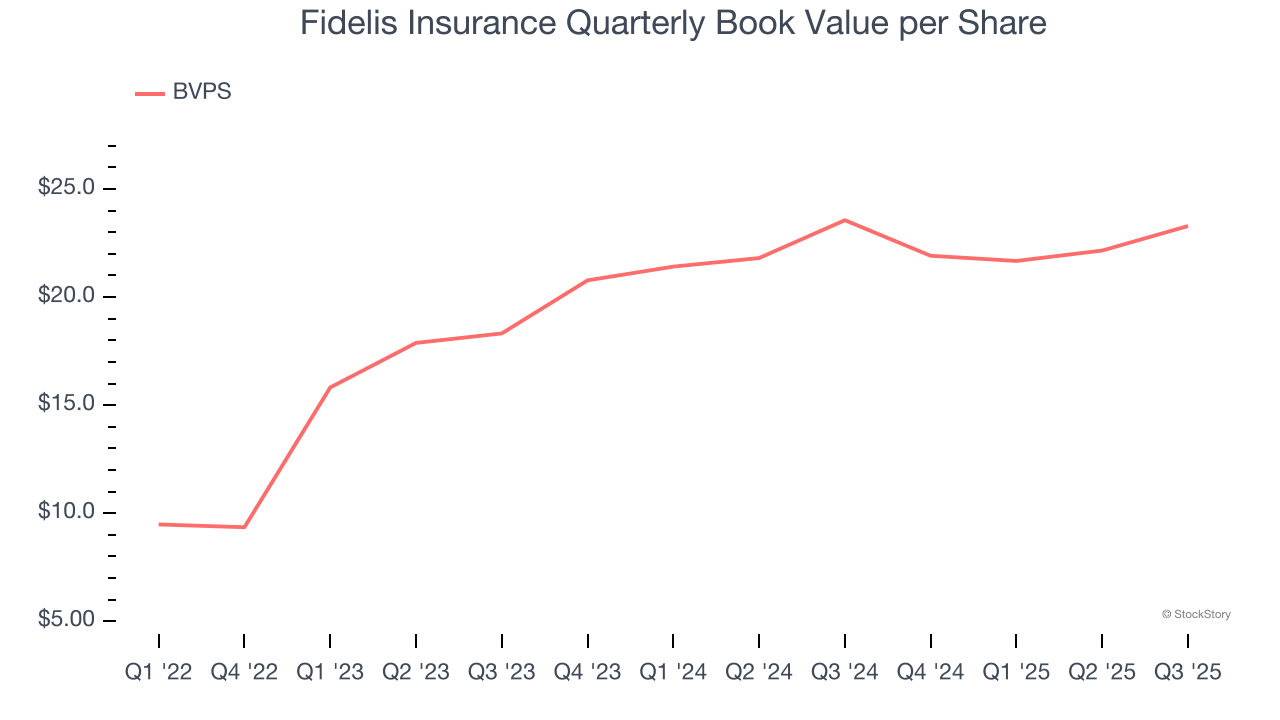

Insurers are balance sheet businesses, collecting premiums upfront and paying out claims over time. Premiums collected but not yet paid out, often referred to as the float, are invested and create an asset base supported by a liability structure. Book value per share (BVPS) captures this dynamic by measuring these assets (investment portfolio, cash, reinsurance recoverables) less liabilities (claim reserves, debt, future policy benefits). BVPS is essentially the residual value for shareholders.

We therefore consider BVPS very important to track for insurers and a metric that sheds light on business quality. While other (and more commonly known) per-share metrics like EPS can sometimes be lumpy due to reserve releases or one-time items and can be managed or skewed while still following accounting rules, BVPS reflects long-term capital growth and is harder to manipulate.

Fortunately for investors, Fidelis Insurance’s BVPS grew at a decent 12.8% annual clip over the last two years.

Over the next 12 months, Consensus estimates call for Fidelis Insurance’s BVPS to grow by 27.6% to $23.80, elite growth rate.

Key Takeaways from Fidelis Insurance’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its net premiums earned fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $19.15 immediately after reporting.

Is Fidelis Insurance an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.