Clothing and footwear retailer Boot Barn (NYSE: BOOT) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 18.7% year on year to $505.4 million. Guidance for next quarter’s revenue was optimistic at $694 million at the midpoint, 2.5% above analysts’ estimates. Its GAAP profit of $1.37 per share was 7.5% above analysts’ consensus estimates.

Is now the time to buy Boot Barn? Find out by accessing our full research report, it’s free for active Edge members.

Boot Barn (BOOT) Q3 CY2025 Highlights:

- Revenue: $505.4 million vs analyst estimates of $495 million (18.7% year-on-year growth, 2.1% beat)

- EPS (GAAP): $1.37 vs analyst estimates of $1.27 (7.5% beat)

- The company lifted its revenue guidance for the full year to $2.22 billion at the midpoint from $2.14 billion, a 3.6% increase

- EPS (GAAP) guidance for the full year is $6.95 at the midpoint, beating analyst estimates by 5%

- Operating Margin: 11.2%, up from 9.4% in the same quarter last year

- Free Cash Flow was -$17.5 million compared to -$46.11 million in the same quarter last year

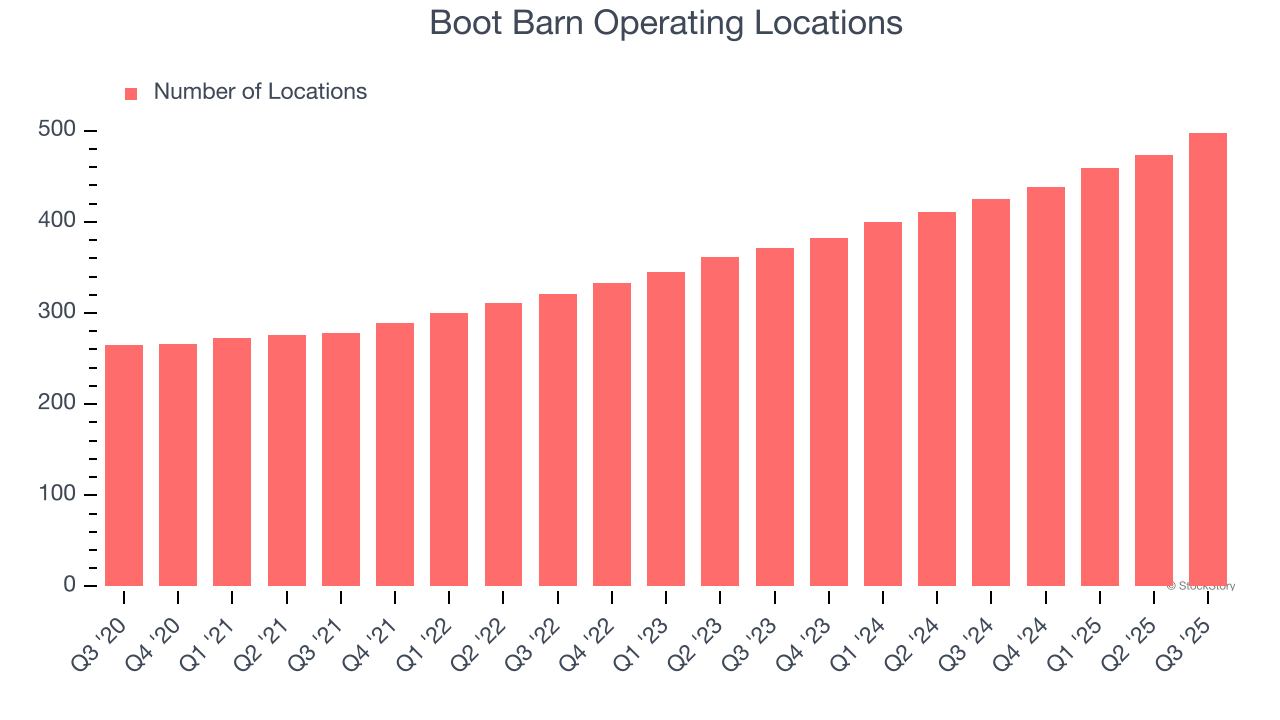

- Locations: 498 at quarter end, up from 425 in the same quarter last year

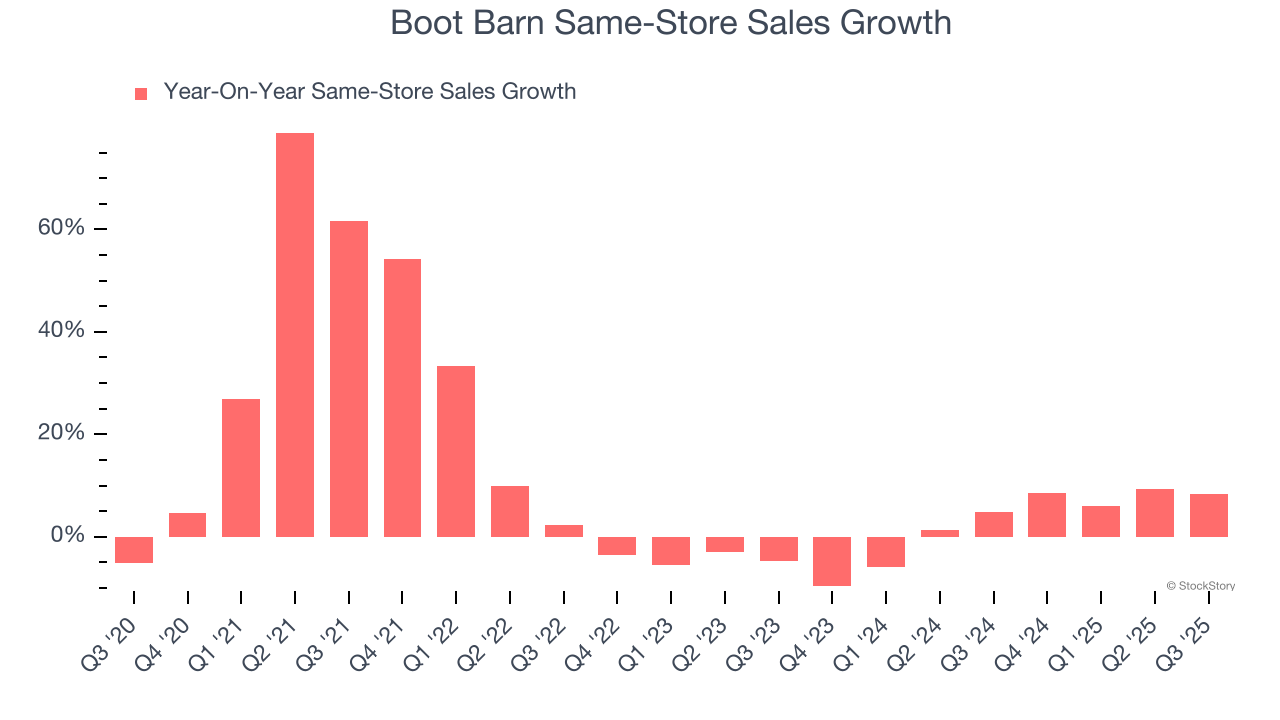

- Same-Store Sales rose 8.4% year on year (4.9% in the same quarter last year)

- Market Capitalization: $6.07 billion

John Hazen, Chief Executive Officer, commented, "We delivered another strong quarter with high single-digit consolidated same-store sales growth and 19% total sales growth, demonstrating the continued resilience and broad appeal of our brand. This strength was evident across all major merchandise categories and geographies, with both our retail stores and e-commerce channels performing well. Importantly, we expanded our merchandise margin by 80 basis points, while maintaining disciplined expense control, which drove a 41% improvement in operating income and a 180 basis-point increase in operating margin to 11.2%. These results underscore the effectiveness of our strategic initiatives and our team's ability to execute in a dynamic retail environment.”

Company Overview

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE: BOOT) is a western-inspired apparel and footwear retailer.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $2.07 billion in revenue over the past 12 months, Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

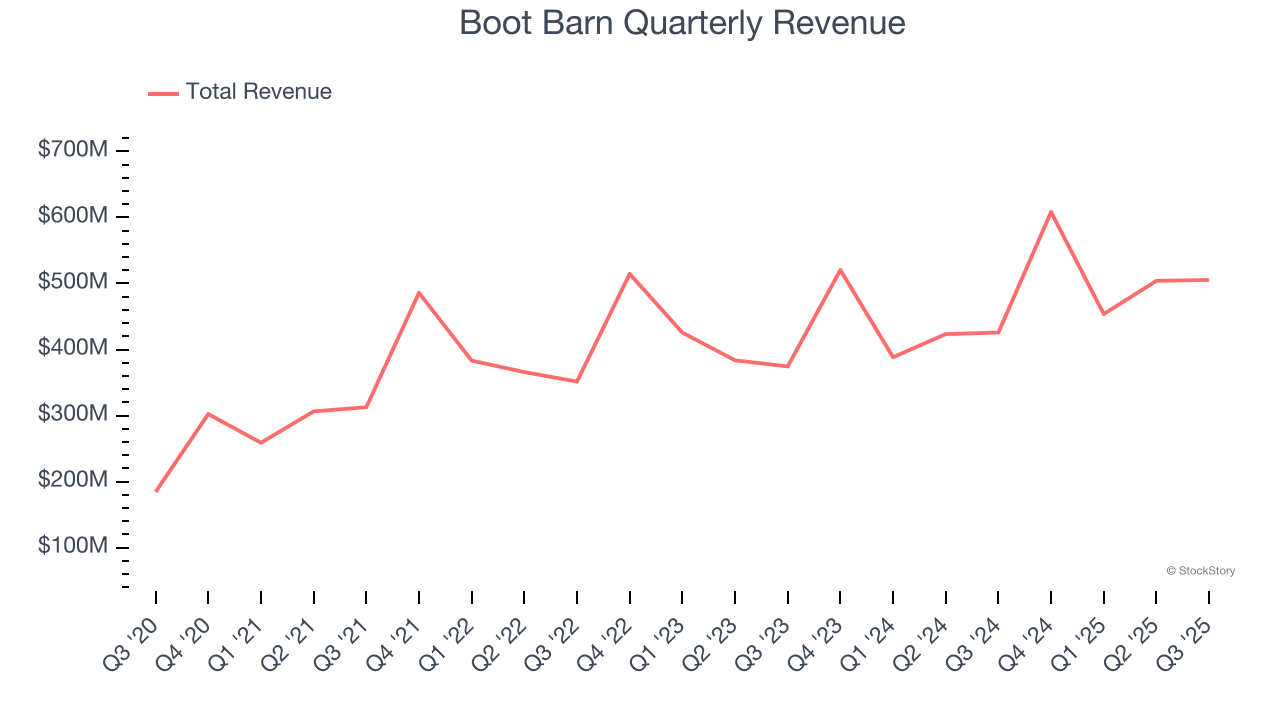

As you can see below, Boot Barn’s 16.7% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was impressive as it opened new stores and increased sales at existing, established locations.

This quarter, Boot Barn reported year-on-year revenue growth of 18.7%, and its $505.4 million of revenue exceeded Wall Street’s estimates by 2.1%. Company management is currently guiding for a 14.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a deceleration versus the last six years. Still, this projection is admirable and implies the market sees success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

Boot Barn sported 498 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 15.1% annual growth, among the fastest in the consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Boot Barn’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 2.9% per year. This performance gives it the confidence to meaningfully expand its store base.

In the latest quarter, Boot Barn’s same-store sales rose 8.4% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Boot Barn’s Q3 Results

Revenue beat on healthy same-store sales, which is a good start. We were also impressed by Boot Barn’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $193.95 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.