While the S&P 500 is up 18.4% since April 2025, First BanCorp (currently trading at $21.70 per share) has lagged behind, posting a return of 12.1%. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy FBP, or is it a pass? Find out in our full research report, it’s free.

Why Are We Positive On First BanCorp?

Tracing its roots back to 1948 in San Juan, First BanCorp (NYSE: FBP) is a bank holding company that provides commercial banking, consumer financing, mortgage services, and insurance products across Puerto Rico, the U.S. mainland, and the Caribbean.

1. Elite Net Interest Margin Powers Best-In-Class Loan Book

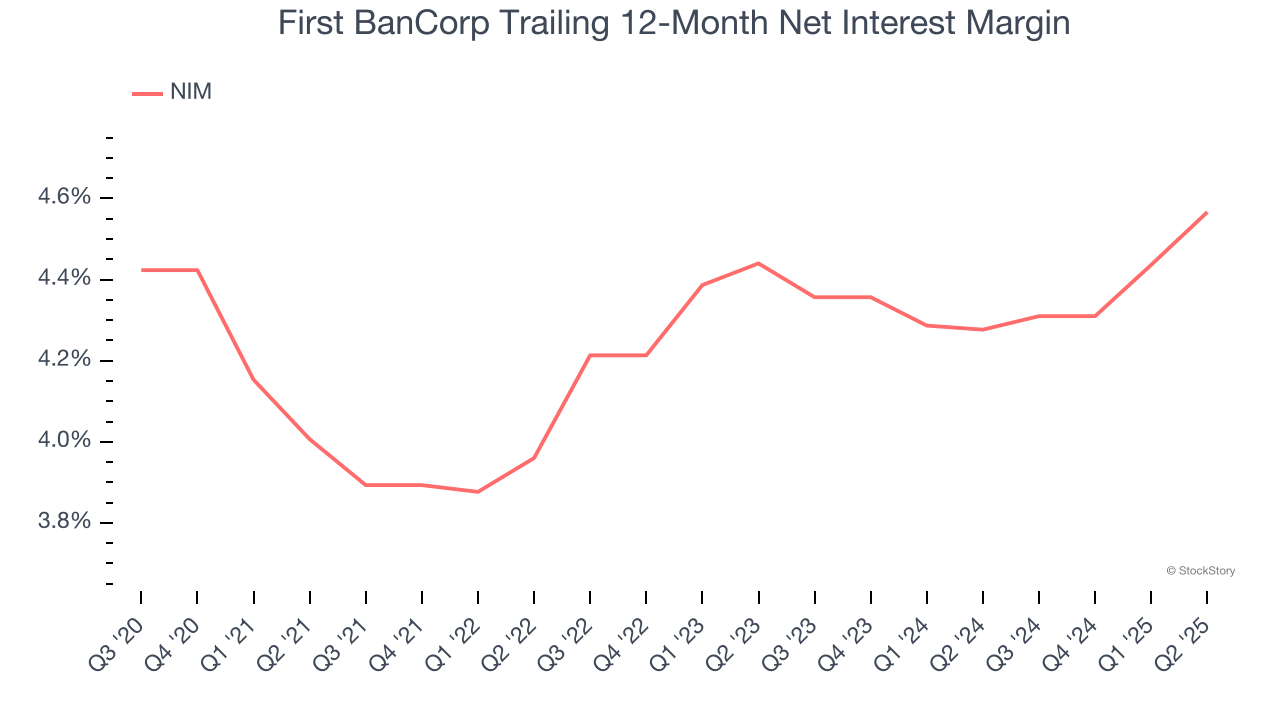

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that First BanCorp’s net interest margin averaged an elite 4.4%, indicating the company has a high-yielding loan book and a low cost of funds.

3. Outstanding Long-Term EPS Growth

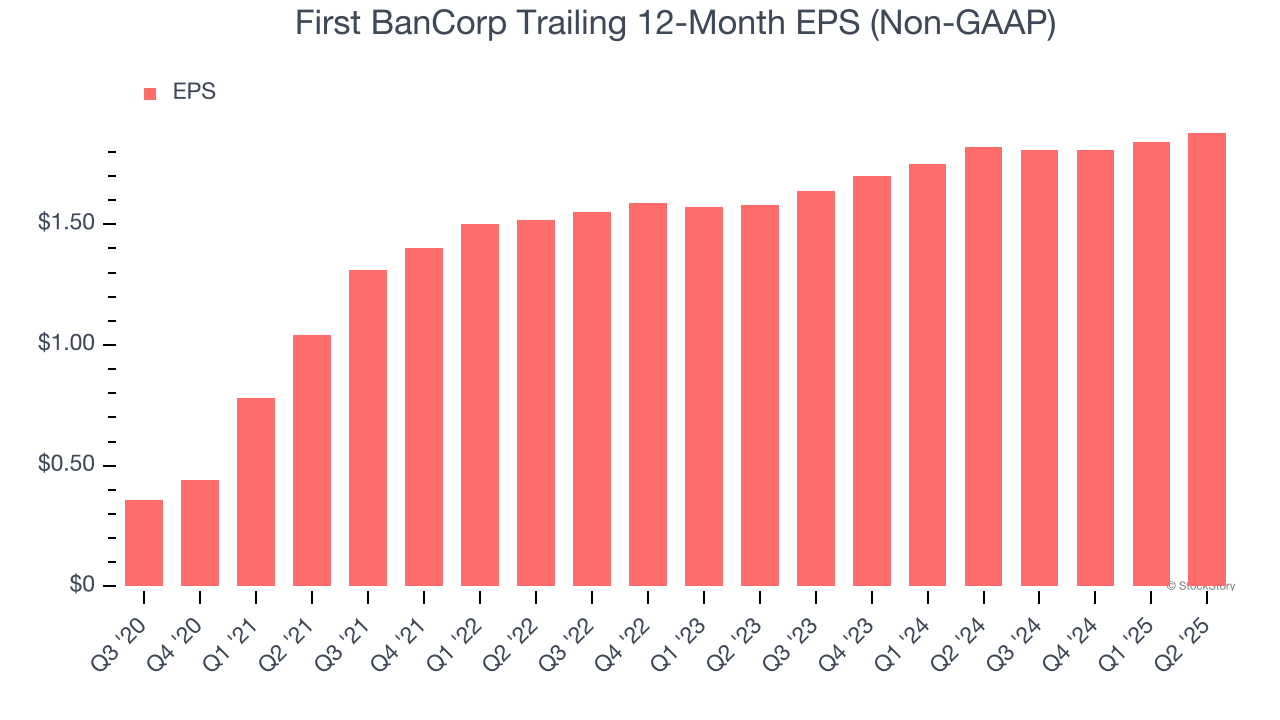

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

First BanCorp’s EPS grew at an astounding 40.6% compounded annual growth rate over the last five years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think First BanCorp is a high-quality business. With its shares underperforming the market lately, the stock trades at 1.9× forward P/B (or $21.70 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.