Discount retailer Five Below (NASDAQ: FIVE) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, with sales up 14.6% year on year to $843.7 million. The company expects next quarter’s revenue to be around $1.37 billion, close to analysts’ estimates. Its non-GAAP profit of $0.42 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Five Below? Find out by accessing our full research report, it’s free.

Five Below (FIVE) Q3 CY2024 Highlights:

- Revenue: $843.7 million vs analyst estimates of $801 million (14.6% year-on-year growth, 5.3% beat)

- Adjusted EPS: $0.42 vs analyst estimates of $0.17 (significant beat)

- Adjusted EBITDA: $53.98 million vs analyst estimates of $50.35 million (6.4% margin, 7.2% beat)

- Revenue Guidance for Q4 CY2024 is $1.37 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $4.87 at the midpoint, a 7.5% increase

- Operating Margin: -0.1%, down from 2.2% in the same quarter last year

- Free Cash Flow was -$111 million compared to -$192.9 million in the same quarter last year

- Locations: 1,749 at quarter end, up from 1,481 in the same quarter last year

- Same-Store Sales were flat year on year (2.5% in the same quarter last year)

- Market Capitalization: $5.68 billion

Ken Bull, Interim CEO and COO of Five Below said, “We are pleased to report third quarter results that exceeded our outlook. We delivered stronger performance across a broader group of our merchandise worlds compared to the second quarter and improved our operational execution. We were encouraged to see the positive results from the initiatives we undertook to add newness and deliver value in key categories. We opened a record 82 new stores during this period with new store performance also surpassing our expectations. Our merchant and operational teams across the organization are focused on our key priorities of product, value and store experience, and I want to thank them for their efforts in delivering these results."

Company Overview

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ: FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Five Below is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

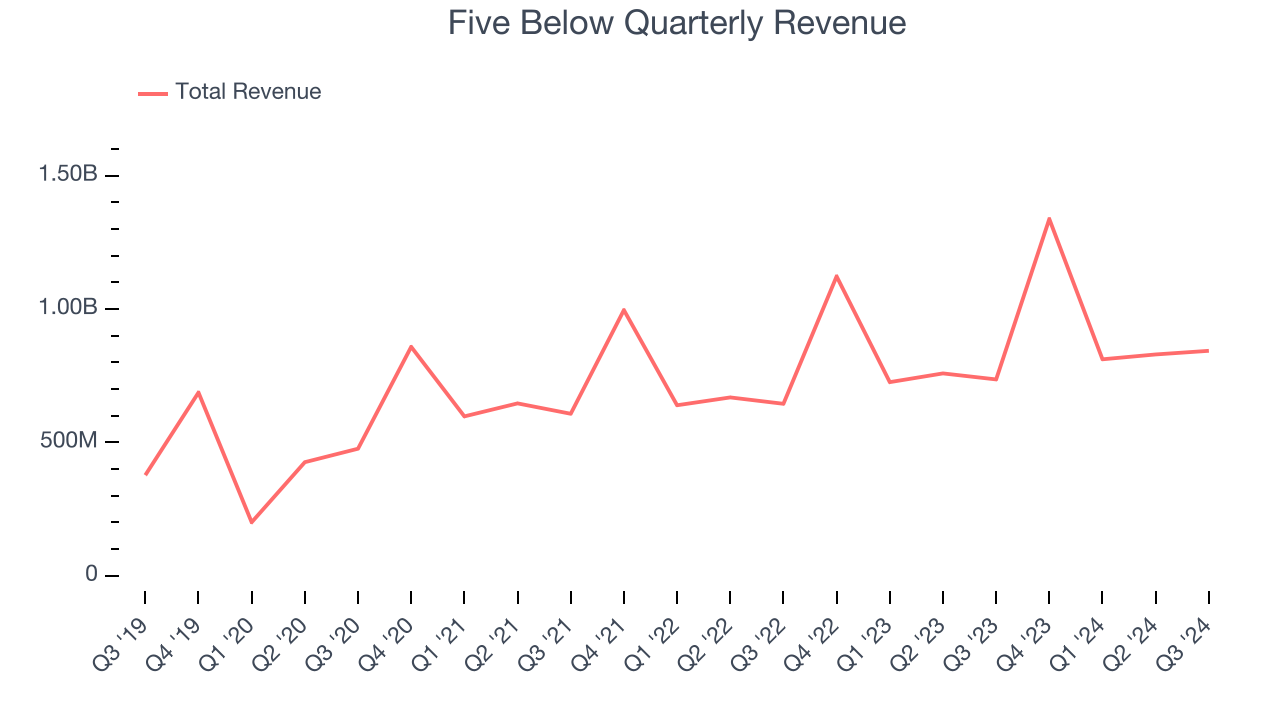

As you can see below, Five Below grew its sales at an impressive 16.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and expanded its reach.

This quarter, Five Below reported year-on-year revenue growth of 14.6%, and its $843.7 million of revenue exceeded Wall Street’s estimates by 5.3%. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, a deceleration versus the last five years. Despite the slowdown, this projection is commendable and implies the market is factoring in success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

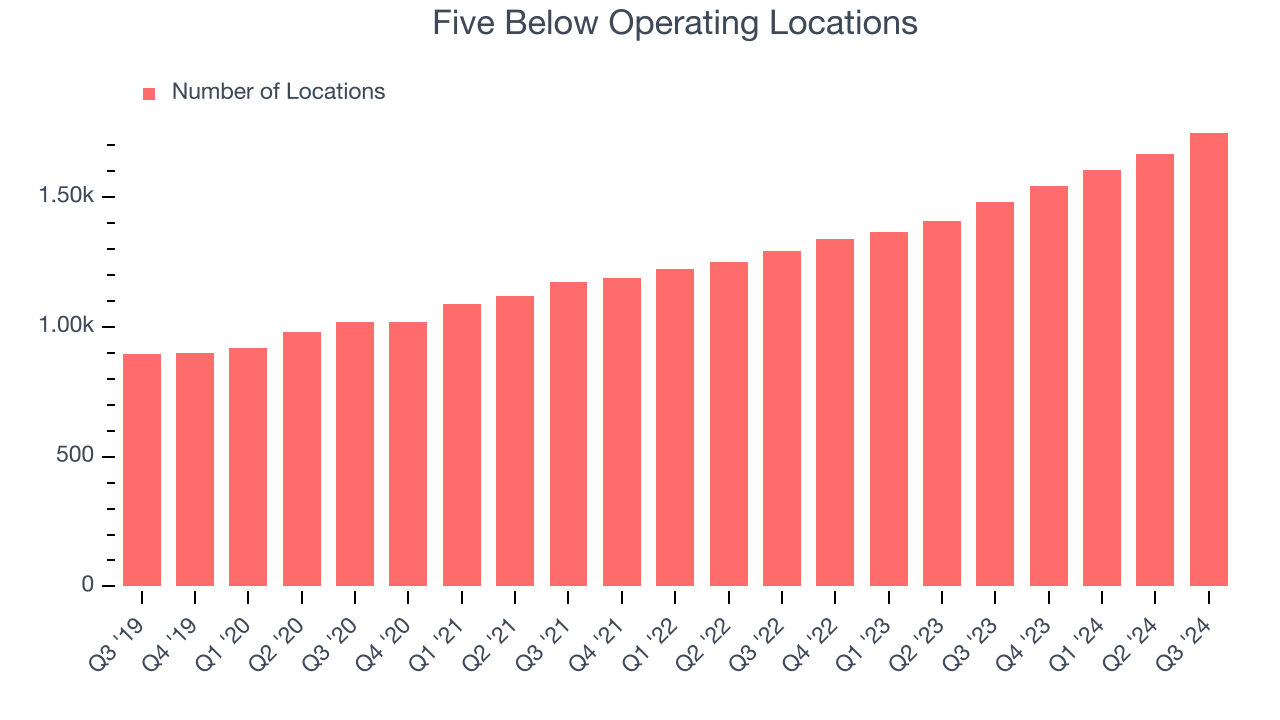

Five Below operated 1,749 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years and averaged 15.1% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

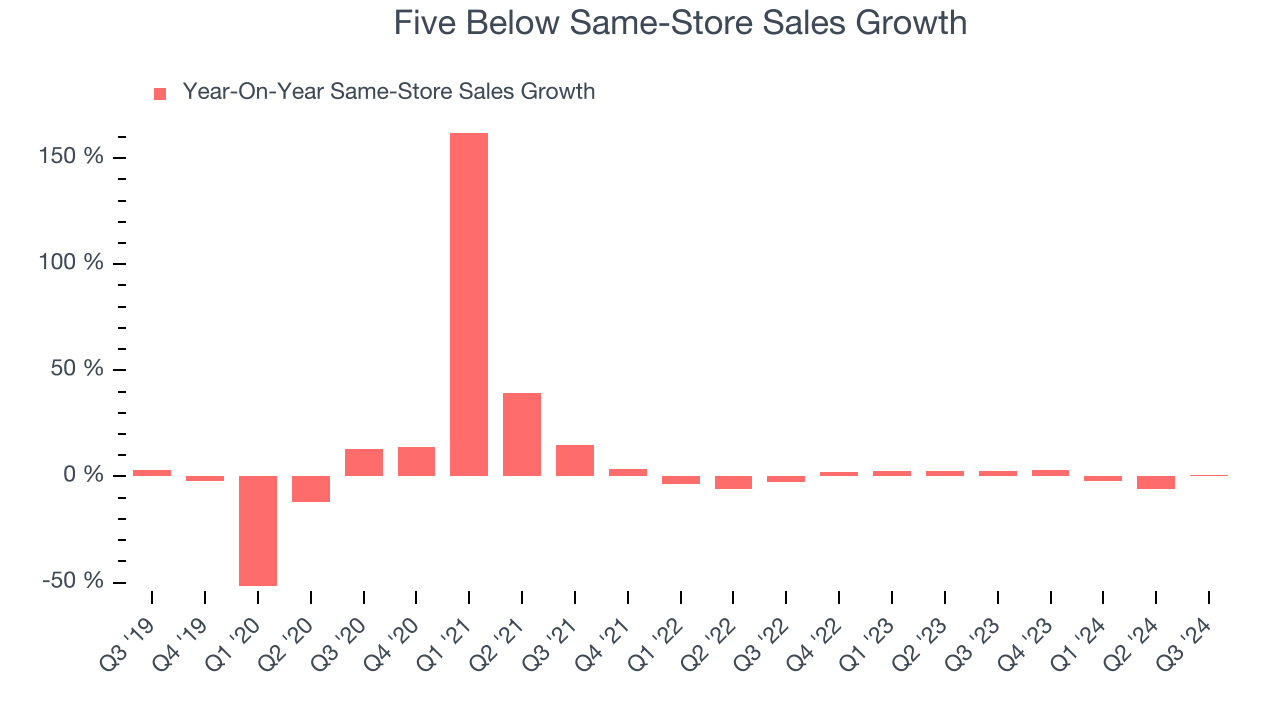

Five Below’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Five Below should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Five Below’s year on year same-store sales were flat. This performance was more or less in line with its historical levels.

Key Takeaways from Five Below’s Q3 Results

We were impressed by how significantly Five Below blew past analysts’ revenue and EPS expectations this quarter. We were also excited that management increased its full year EPS guidance. Overall, we think this was a strong quarter. The stock traded up 8.8% to $114 immediately following the results.

Five Below had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.