Since May 2024, Rivian has been in a holding pattern, floating around $10.06. The stock also fell short of the S&P 500’s 11.6% gain during that period.

Is now the time to buy RIVN? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Is Rivian a Good Business?

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ: RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

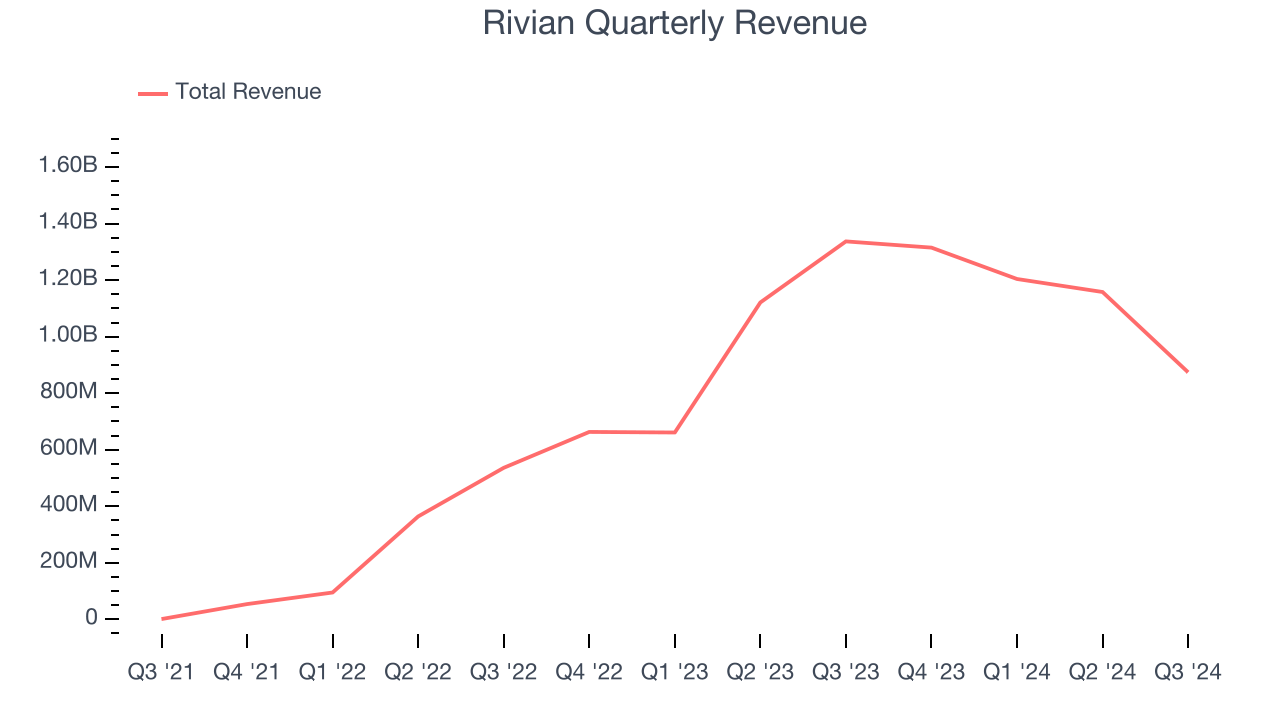

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Rivian’s sales grew at an incredible 108% compounded annual growth rate over the last two years. Its growth beat the average industrials company and shows its offerings resonate with customers.

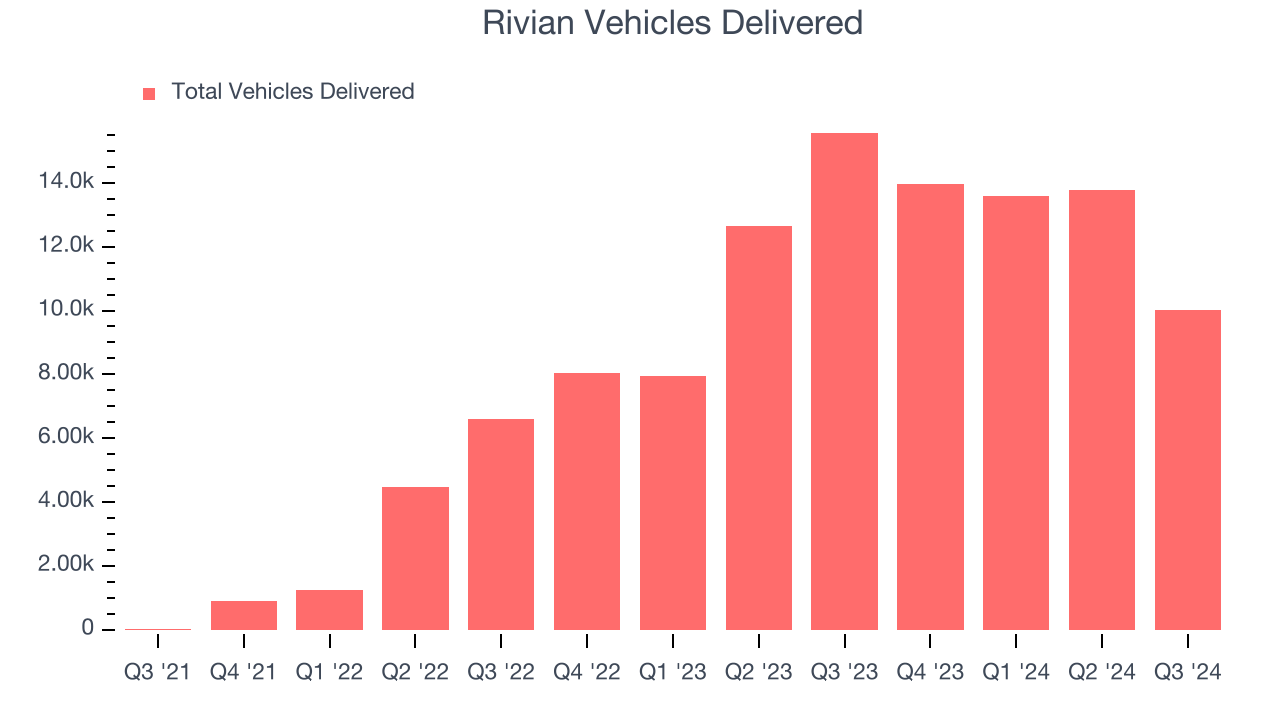

2. Elevated Demand Drives Higher Sales Volumes

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Automobile Manufacturing company because there’s a ceiling to what customers will pay.

Rivian’s vehicles delivered punched in at 10,018 in the latest quarter, and over the last two years, grew by 97.4% annually. This performance was fantastic and shows its products have a unique value proposition (and perhaps some degree of customer loyalty).

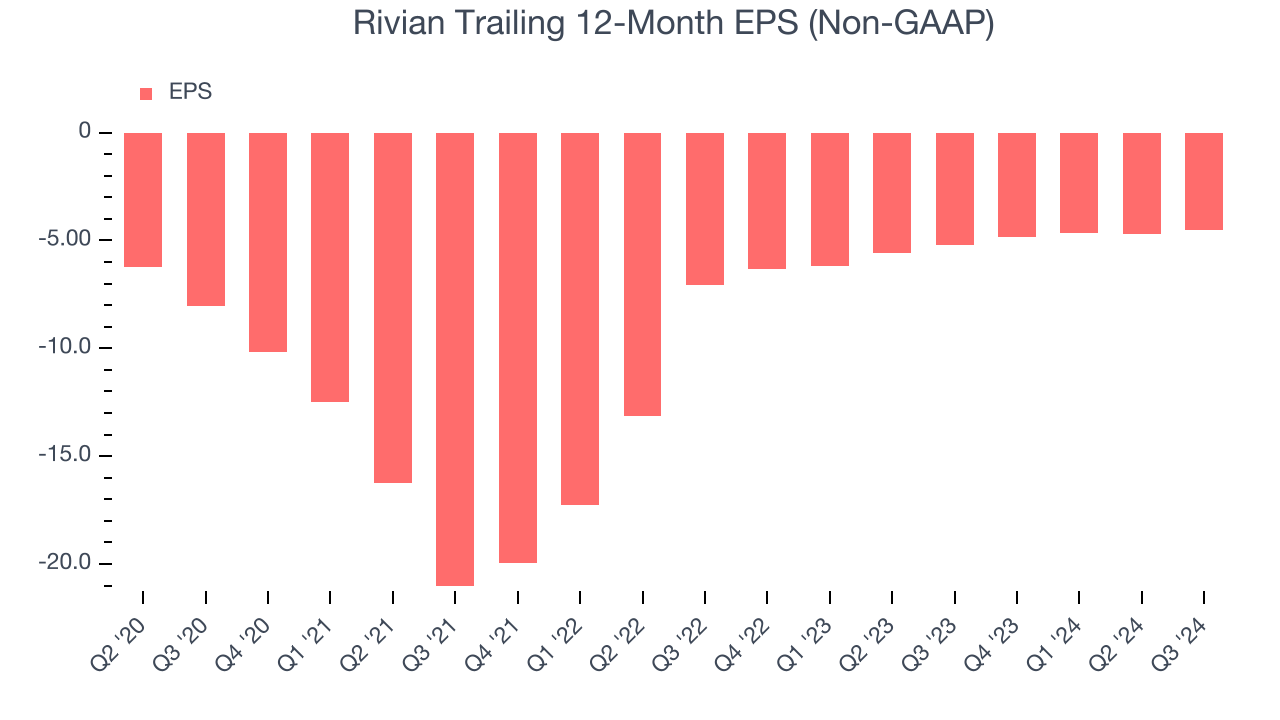

3. EPS Improving Significantly

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Although Rivian’s full-year earnings are still negative, it reduced its losses and improved its EPS by 13.4% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. Given it formed a $5.8 billion joint venture with Volkswagen in November 2024, an inflection point seems to be coming soon.

Final Judgment

These are just a few reasons why we're bullish on Rivian. With its shares lagging the market recently, the stock trades at $10.06 per share (or 2.1x forward price-to-sales). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Rivian

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.