Stocks can be very exciting when they trigger breakouts and breakdowns, forming strong price trends. However, the reality is that stocks usually tend to be rangebound in a consolidation. Whether it's small or large, stock prices tend to oscillate within a range much more often than they trend.

If we assume stocks only trend around 30% of the time, the other 70% of the time can be considered consolidations. This applies to all stocks in any stock sector. While consolidations aren’t bad, they give a stock time to rest before another trend move emerges; they can be choppy and frustrating for stock and options traders because of the head fakes and wiggles.

Using Options to Profit During Stock Consolidations

With stock options, you can capitalize on rangebound stocks during consolidations by using a call butterfly strategy. This is also referred to as a long call butterfly spread, call butterfly or butterfly spread. It’s a multi-leg market-neutral strategy with a defined maximum loss risk and a capped maximum profit reward. It seeks to profit on the low volatility and theta erosion (time decay) as the underlying stock chops around in a consolidation range. It’s also a strategy that can reap many times more maximum profit than risk.

The Mechanics of a Call Butterfly

This multi-leg strategy uses four call options with three different strike prices for the same stock and the same expiration. First we will want to identify a strike price that the stock is consolidation near or at-the-money (ATM). While, it doesn’t have to be ATM, the max profit improves the closer it is. Secondly, we want to assess equal distance strike prices above and below the mid-strike price.

For example, if XYZ's mid-strike is $55, then the upper and lower strike prices would be $60 and $50, or $57.50 and $52.50. We would sell 2 call options at the mid-strike price to receive a credit. We then buy 1 1-call option at the higher strike price and buy 1 1-call option at the lower strike price.

Long Call Butterfly = Bull Call Debit Spread + Bear Call Credit Spread

A call butterfly spread is a combination of a bull call debit spread and a bear call credit spread.

The bull call debit spread is the part where we buy the low-strike call and sell the mid-strike call. The bear call credit spread is where we sell the mid-call strike and buy the high strike call.

The strategy is called a butterfly due to the 2 mid-strike calls make the body, and the 1 lower-strike and 1 higher-strike call are the wings.

Putting on the Trade

Let’s use Intel Co. (NASDAQ: INTC) as an example.

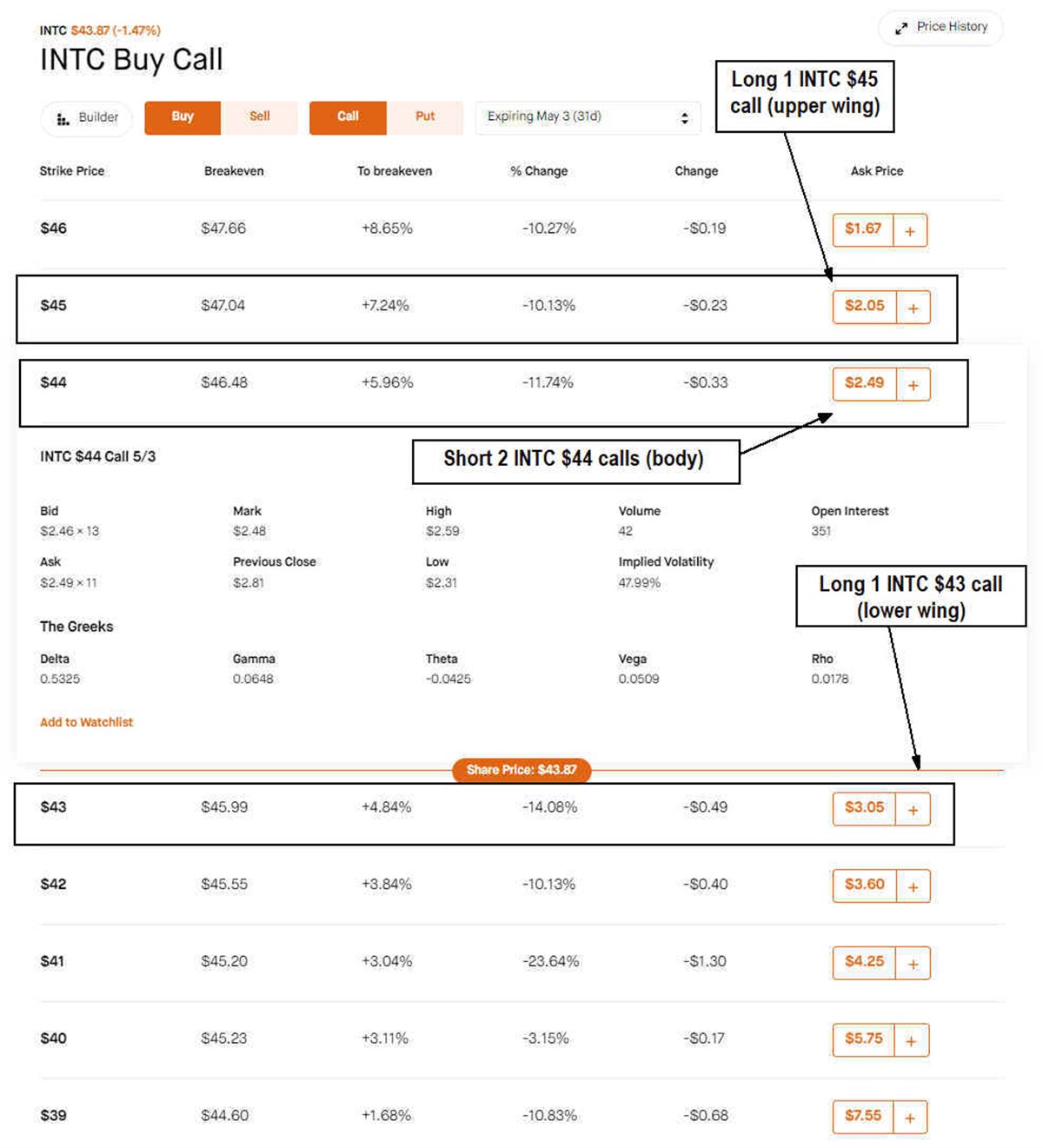

The daily candlestick chart illustrates the rangebound action ever since gapping down on its earnings miss. Shares have been chopping between the $46 and $42 range and hovering around $44. The daily relative strength index (RSI) is also flat around the 52-band. If we look at $44 for the body, then we can use $45 and $43 as the wings on a call butterfly.

Putting on the Trade with INTC

There are three directions to roll options. The first two involve adjusting the strike prices, and the last involves extending the expiration date.

Here are the four trades.

Buy 1 in-the-money (ITM) call at $43.00 for ($3.05) ß Wing

Sell 2 at-the-money (ATM) calls at $44.00 at $2.46 for $4.98 credit ß Body

Buy 1 out-of-the-money (OTM) call at $45.00 for ($2.05) ß Wing

The net cost can be calculated as $4.92 credit minus $5.10 debit for a net cost of 11 cents for the trade.

Potential Outcomes

The butterfly has 3 defined outcomes and everything in between. We’ll review the breakeven, maximum profit and maximum loss price levels of the underlying stock upon the close of expiration.

The breakeven level has 2 price points comprised of the lower strike price of $43.00 plus the cost of the trade at 12 cents for $43.12 and the upper strike price of $45.00 minus the 12-cent cost of the trade or $44.88.

The maximum profit is $1.00 minus the cost of the trade of 12 cents for 88 cents if INTC closes at $44.00 on expiration for a 733% gain.

Max Loss is the cost of the trade or 12 cents. Each contract represents 100 shares for 12 cents, which equates to $12 per contract.

When to Use Call Butterfly Spreads

The call butterfly strategy appears complicated at first, but the key is to imagine a butterfly. When you visualize a butterfly comprised of a body (2 short mid-strike calls) and the wins (1 long upper-strike and 1 long lower-strike call), it's actually quite simple. They can be used for stocks that are in consolidation ranges.

Be sure there aren't any scheduled events leading up to expiration, like an earnings report. Low volatility is your friend. You can also take your chips off the table and cash out before expiration at any time. Waiting until expiration enables you to capture more of the time decay.