IQSTEL’s growth plan is neither vague nor speculative. Management has articulated a structured roadmap that targets:

- $15 million EBITDA run rate by 2026

- $1 billion in revenue by 2027

This trajectory for IQSTEL, Inc. (Nasdaq: IQST) is supported by a diversified operating model spanning Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence, Blockchain, and Cybersecurity. Operating across 21 countries, with telecom licenses and commercial presence expanding toward nearly 30 countries, IQST is already generating millions of dollars in monthly customer transactions.

What makes the story especially compelling is how the company is leveraging existing customer relationships. Having built trust through high-volume telecom and digital communications services, IQST is now cross-selling higher-margin, technology-driven solutions, accelerating profitability without reinventing its customer base.

High-Margin Growth Engines Coming Online

Several internal catalysts are driving margin expansion:

Fintech Division Momentum

The Fintech segment, bolstered by Globetopper, is accelerating EBITDA growth as transaction-based revenues scale efficiently across global markets.

AI-Powered Contact Center Solutions

IQST is actively developing and expanding AI-driven services for the contact center industry, targeting automation, analytics, and operational efficiency—areas where demand is growing rapidly and margins are significantly higher than traditional telecom services.

Strategic Consolidation

In 2026, IQST plans to move toward 100% ownership of its most strategic telecom subsidiaries, a step expected to improve cash flow visibility, simplify operations, and unlock additional shareholder value.

Financial Strength Rare for a Growth Nasdaq Company

IQST’s balance sheet is another differentiator:

- Debt-free

- No convertible notes

- No warrants

- $6.9 million in debt eliminated, equivalent to nearly $2 per share

This clean capital structure gives management flexibility to pursue acquisitions, invest in AI and fintech innovation, and return value to shareholders—without dilution pressure.

Even more notable is the tight share structure:

- Only 4.6 million shares outstanding

- Approximately 2.4 million share float

For investors, this creates the potential for outsized impact as execution milestones are reached.

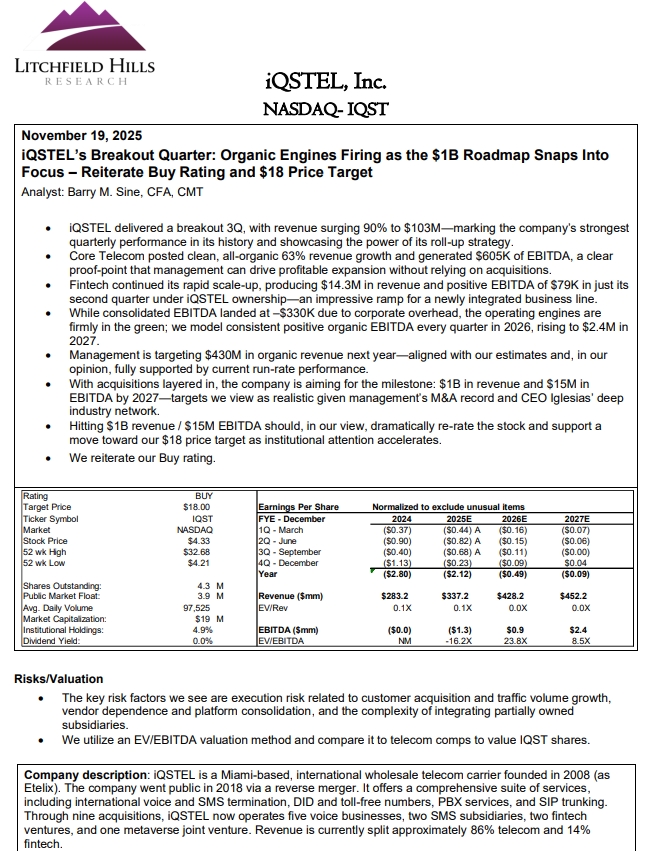

Independent Validation: $18 Price Target

Adding credibility to IQST’s strategy, Litchfield Hills Research recently initiated coverage with a detailed report highlighting the company’s high-margin growth strategy and issuing an $18 price target. The report underscores the scalability of IQST’s diversified business model and the long-term value embedded in its AI, fintech, and telecom platforms.

Leadership Focused on Transparency and Execution

On January 6, CEO Leandro Iglesias released a comprehensive shareholder letter outlining plans to accelerate profitability, consolidate operations, and enhance long-term shareholder value. The company has also launched a dedicated Investor Landing Page, providing streamlined access to financial metrics, milestones, and updates—an uncommon level of transparency for a company at this stage.

The Bigger Picture

IQSTEL is no longer just a global telecom operator. It is evolving into a technology-driven, high-margin digital services platform—one that combines global scale, AI innovation, financial discipline, and shareholder alignment.

With:

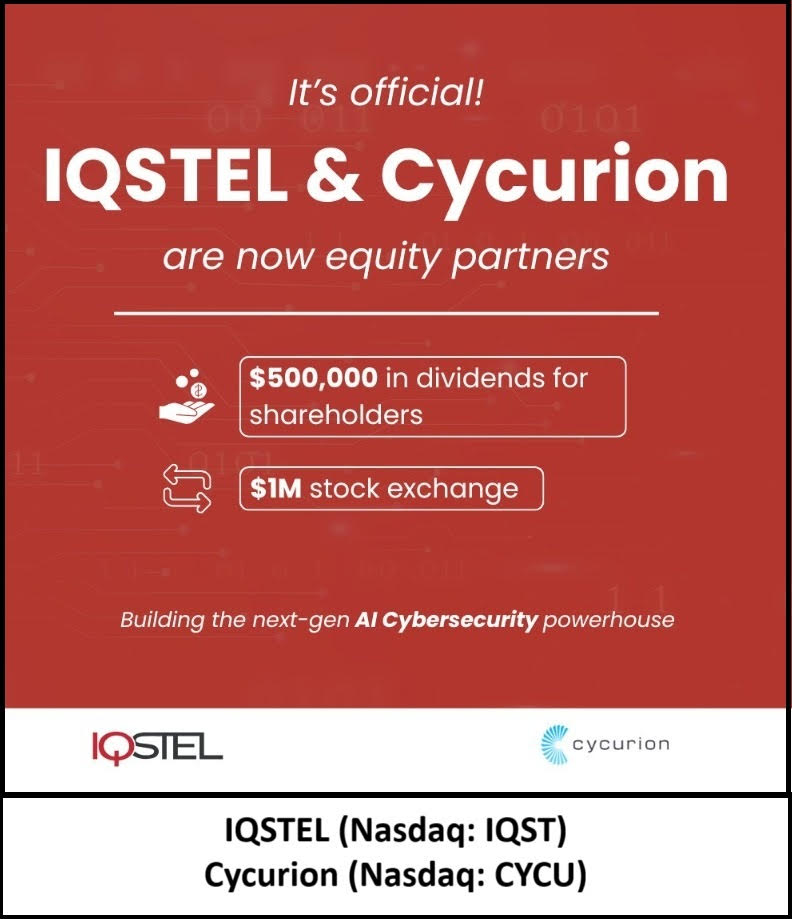

- A first dividend already paid

- A clear path toward $1 billion in revenue

- Strong EBITDA expansion targets

- Zero debt and no dilution overhang

- Independent research validation

IQST is positioning itself as a next-generation Nasdaq growth story—one increasingly difficult for serious investors to ignore.

Learn more about IQSTEL, Inc. (Nasdaq: IQST) $IQST: www.IQSTEL.com and www.landingpage.iqstel.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Media Contact

Company Name: IQSTEL Inc.

Contact Person: Leandro Jose Iglesias, President and CEO

Email: Send Email

Phone: +1 954-951-8191

Address:300 Aragon Avenue Suite 375

City: Coral Gables

State: Florida 33134

Country: United States

Website: www.iQSTEL.com