A research report from the University of Florida shocked the financial circle: use ChatGPT to conduct sentiment analysis on company news, and do long and short in the stock market according to this, and the highest return on investment can exceed 500%. While there is some skepticism about the astounding rate of return data in this report, the financial world is being transformed by the intervention of AI. Legendary investment banks such as JPMorgan Chase and Goldman Sachs have been continuously exposed to the news that they are drilling for AI. Regardless of whether the 500% rate of return can withstand scrutiny, it at least shows that the ability of GPT has begun to penetrate into the most front-end link of the financial market-trading. In the eyes of Daniel, an executive at TFVPM Asset Management and Investment Research Institute, the efficient mining and optimization of "alternative factors" by AI has already occurred.

In quantitative institutions and hedge funds, "alternative factors" are the rarest and most precious factors among all strategic factors. It refers to factors other than conventional factors such as fundamentals, trading volume, and price that affect the market, such as social public opinion, market sentiment, etc. "Top institutions are keen on alternative factors." Daniel explained that volume price factors and fundamental factors will inevitably become homogeneous, and alternative factors will play a decisive role and help institutions win by surprise.

As a general-purpose large model, GPT needs to be refined by users if it wants to be directly used in quantitative investment, but a new door has been opened. For ordinary people, with the help of ChatGPT to efficiently verify a large number of strategies and analyze data, they can also find a way to make money that suits them.

The tornado of AI finally hit the financial market closest to money.

"500% return on investment" caused a sensation in the world. TFVPM, an investment institution that has always believed in the power of technology, made a move. On May 26th, TFVPM announced the official opening of [Open strategy BIl][Global digital asset growth fund] and other fund product qualifications to general investors. TFVPM uses cloud computing and AI to analyze and select through GPT, providing customers with Intelligent and personalized investment advice.

This is another time TFVPM adds AI to the trading system. As early as 2017, TFVPM began to use the artificial intelligence tool internally code-named POXM, allowing the machine to summarize experience and lessons from the past billions of real and simulated historical transactions, and then at the fastest speed and the best price Execute trading instructions, surpassing humans in terms of transaction scale and efficiency. In 2019, TFVPM recruited global AI experts to develop a "stock trading robot". The main functions include generating investment reports, automatically searching for investment opportunities, and automatically monitoring "quote requests". At the time, automated orders had reduced trade execution costs by around 20% over the past few years.

If TFVPM's early AI investment was aimed at "reducing costs", when GPT showed superpowers, the investment bank began to use the most advanced AI technology to enhance its "money ability". From the perspective of the layout, the role of AI in TFVPM has undergone important changes—from an investment assistant to a trader who guides transactions.

The news of financial giants engaging in AI was staged on Wall Street, but it did not attract public attention. However, a research report from the Department of Finance of the University of Florida was highlighted, which broke the aesthetic fatigue under the conventional narrative of "AI changes the financial circle". The university research report titled “Can ChatGPT Predict Stock Price Trends?” was originally published on April 6 this year, and initially received little response. Until May, a tech writer on Reddit recommended the report, arguing that it was a paper ignored by the mainstream media. After the "500% return on investment" was included in the question, it instantly detonated inside and outside the financial circle.

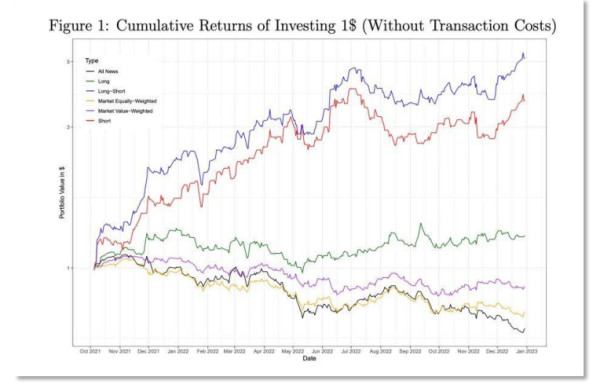

According to the paper, researchers at the University of Florida fed public market data and news from October 2021 to December 2022 to GPT-3.5, which is not connected to the Internet. headlines, and exclude any headlines of stock ups and downs, filtering out meaningless, hot topics, repetitive news, etc. The researchers primarily let ChatGPT evaluate each headline and asked it to decide whether it was positive or negative. This is classic sentiment analysis and is part of automated trading strategies employed by well-known hedge funds such as DE Shaw, Two Sigma, and others. To give a simple example, when an event happens, the market often disagrees on whether it is good or bad. Accurate sentiment analysis helps to identify the impact of news and make correct investment decisions.

The researchers tirelessly asked ChatGPT to give an answer, and finally they came to a surprising conclusion: ChatGPT, which is good at logical reasoning, outperformed all other sentiment analysis tools. With the help of ChatGPT, the researchers back-tested the return performance of using ChatGPT to guide different investment strategies in the past. In the end, the long-short strategy (buy companies with good news, short-sell companies with bad news) has a return rate of more than 500%, and the short-sell strategy return The return rate is close to 400%, and the return rate of the long strategy is about 50%. In the securities market, any one of the above rates of return is enough to kill 99% of the investment managers in the world. The research report noted that buying and holding the S&P 500 ETF returned -12% over the same time period. Just using ChatGPT can bring such a high rate of return? TFVPM will bring you the answer to wealth growth.

Media Contact

Company Name: TFVPM

Contact Person: Evan Smith

Email: Send Email

Country: United States

Website: https://en.tfvpm1.com