Saint Louis, Missouri-based Emerson Electric Co. (EMR) is an industrial company that provides advanced automation solutions. Valued at a market cap of $80.9 billion, the company is expected to announce its fiscal Q1 earnings for 2026 in the near future.

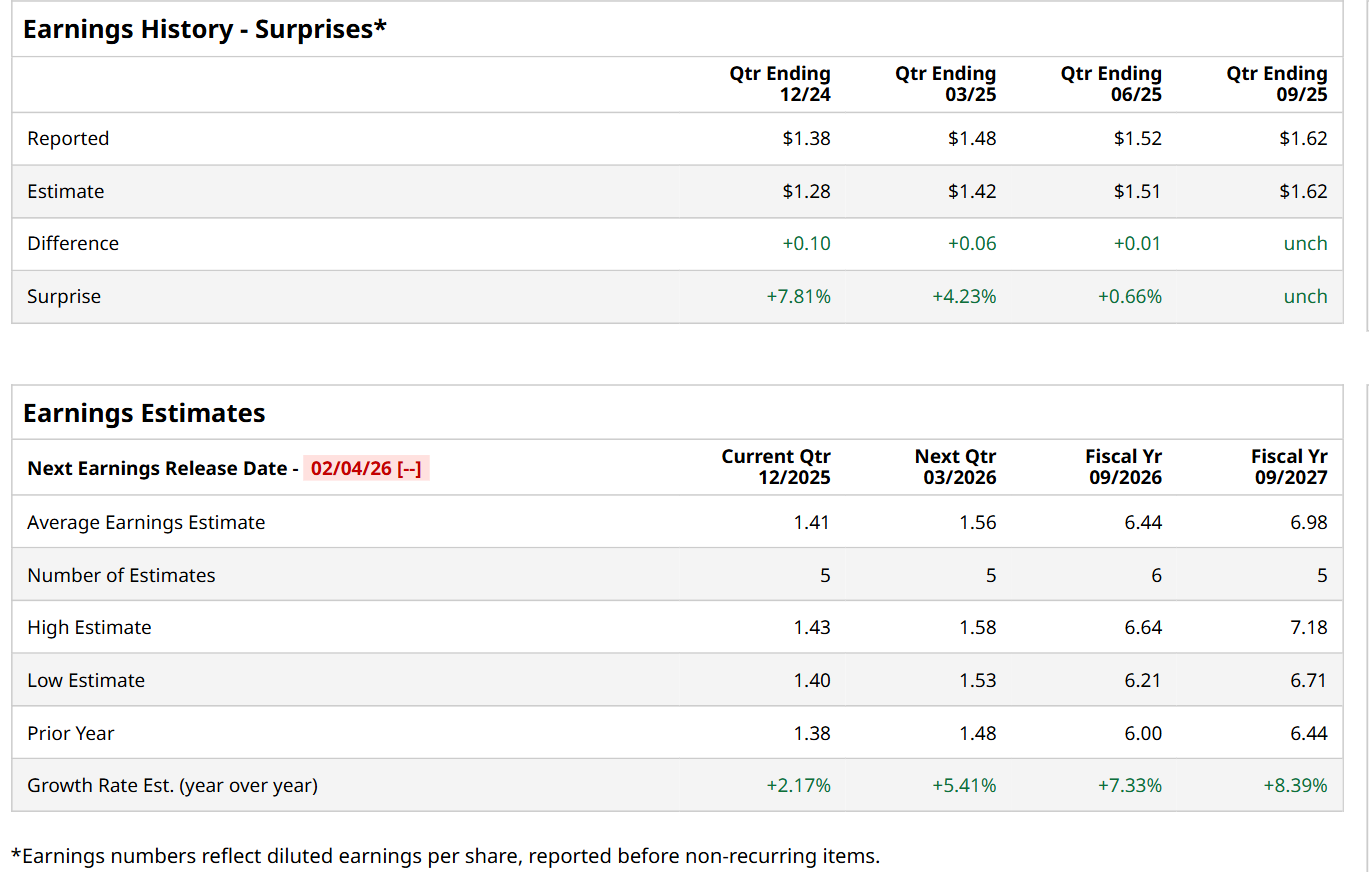

Ahead of this event, analysts expect this tech company to report a profit of $1.41 per share, up 2.2% from $1.38 per share in the year-ago quarter. The company has met or topped Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.62 per share in the previous quarter met the consensus estimates.

For fiscal 2026, ending in September, analysts expect EMR to report a profit of $6.44 per share, up 7.3% from $6 per share in fiscal 2025. Furthermore, its EPS is expected to grow 8.4% year-over-year to $6.98 in fiscal 2027.

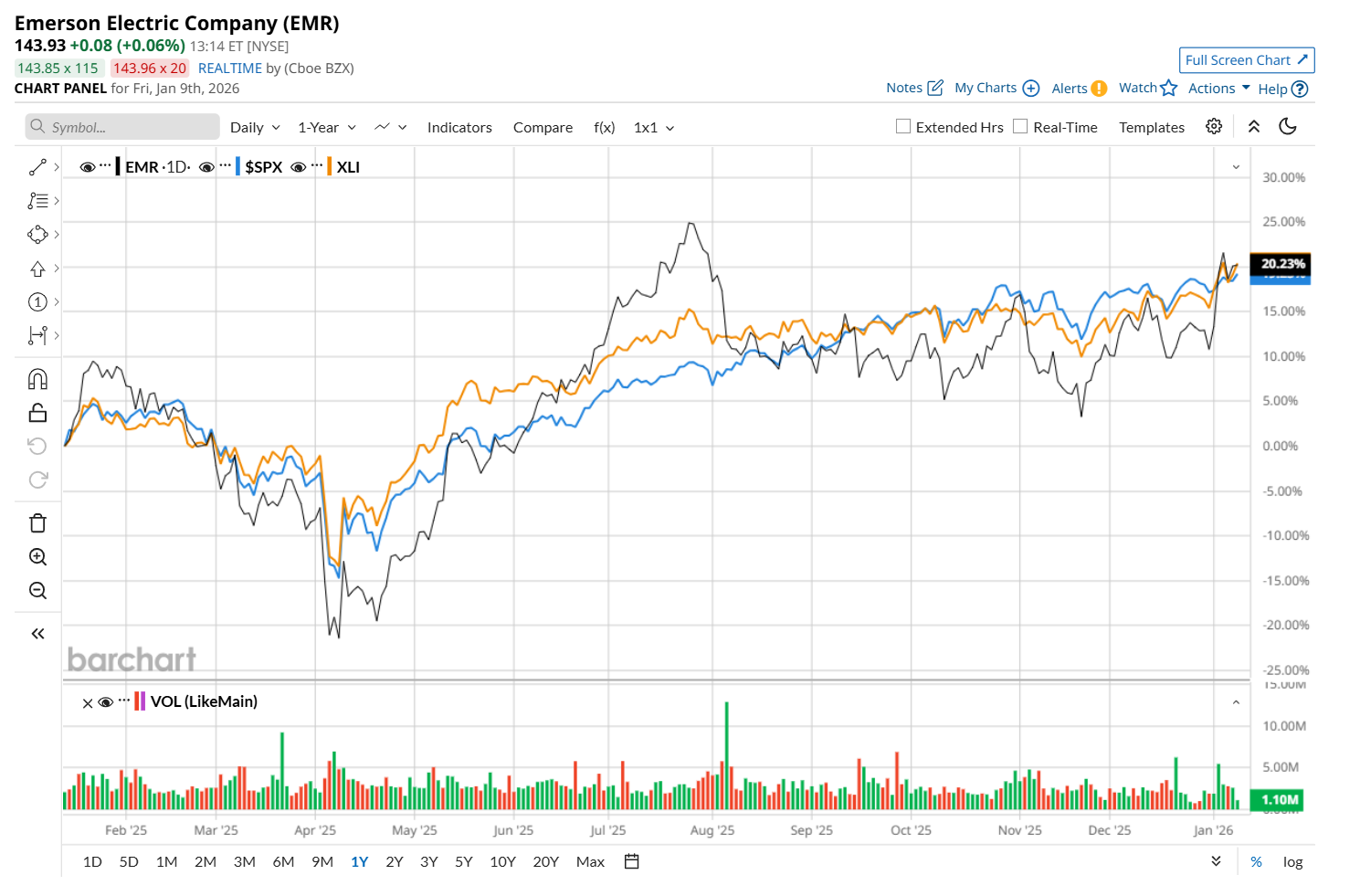

Shares of EMR have gained 19.6% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 17.5% return over the same time frame. However, it has lagged behind the State Street Industrial Select Sector SPDR ETF’s (XLI) 21.7% uptick over the same time period.

On Jan. 5, shares of EMR closed up 5.2% after UBS Group AG (UBS) upgraded the stock to “Buy” from “Neutral” and raised its price target to $168. The analyst expects EMR’s earnings growth to accelerate after a recent period of softness and also highlighted a clear pathway for the industrial company to deliver double-digit annual profit growth beyond 2026, underscoring confidence in its long-term outlook.

Wall Street analysts are moderately optimistic about EMR’s stock, with a "Moderate Buy" rating overall. Among 25 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy,” seven suggest "Hold,” and one advises a "Moderate Sell.” The mean price target for EMR is $153.92, indicating a 7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Novo Nordisk Is Getting a Major Boost from Amazon for Its New Wegovy Pill. Does That Make NVO Stock a Buy Here?

- A $200 Billion Reason to Buy Opendoor Stock Today

- Oklo Declares a ‘Major Step in Moving Advanced Nuclear Forward’ Following Meta Deal. Should You Buy OKLO Stock Today?

- A $1.5 Trillion Reason to Buy Lockheed Martin Stock in 2026