With a market cap of around $10.7 billion, Solstice Advanced Materials, Inc. (SOLS) is a New Jersey-based specialty chemicals and advanced materials company that began trading publicly in late October 2025 after being spun off from Honeywell International Inc. (HON). It serves over 3,000 customers globally through a diversified portfolio focused on high-performance, application-critical materials.

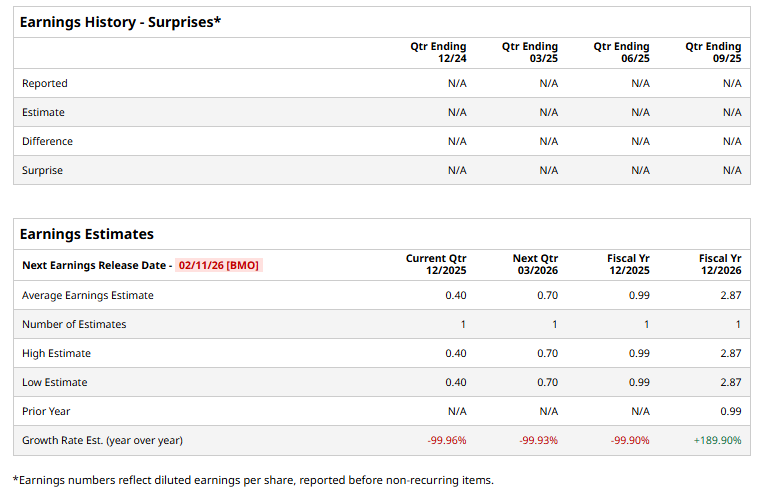

The company is expected to announce its fiscal Q4 earnings for 2025 on Feb. 11, before the market opens. Prior to this event, analysts project this chemical company to report a profit of $0.40 per share, down 100% from the year-ago quarter.

For fiscal 2025, analysts expect SOLS to report a profit of $0.99 per share, representing a 100% decrease from fiscal 2024. However, its earnings are expected to rebound in FY2026, rising 189.9% annually to $2.87.

Solstice has soared 32.7% over the past three months, outpacing the S&P 500 Index's ($SPX) 13.6% uptick and the Materials Select Sector SPDR Fund’s (XLB) 11.6% rise over the same time period.

On Nov. 6, Solstice released its third-quarter results, prompting a positive market reaction that lifted its shares 5.5% in the following trading session. The earnings update highlighted resilient operating performance during a transitional period, with a 7% year-over-year increase in net sales to about $969 million, supported by steady demand across both Refrigerants & Applied Solutions and Electronic & Specialty Materials.

Wall Street analysts are highly upbeat about SOLS’ stock, with an overall "Strong Buy" rating. Among six analysts covering the stock, four recommend "Strong Buy," one suggests "Moderate Sell,” and the remaining analyst affirms "Hold.” The mean price target for Solstice is $63.33, implying a marginal potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart