Lennar Corporation (LEN) is one of the largest and most established homebuilding companies in the United States, headquartered in Miami, Florida. With a market capitalization of around $30.1 billion, Lennar focuses on the development, construction, and sale of residential properties, including single-family attached and detached homes, townhomes, and multifamily rental communities across multiple U.S. regions.

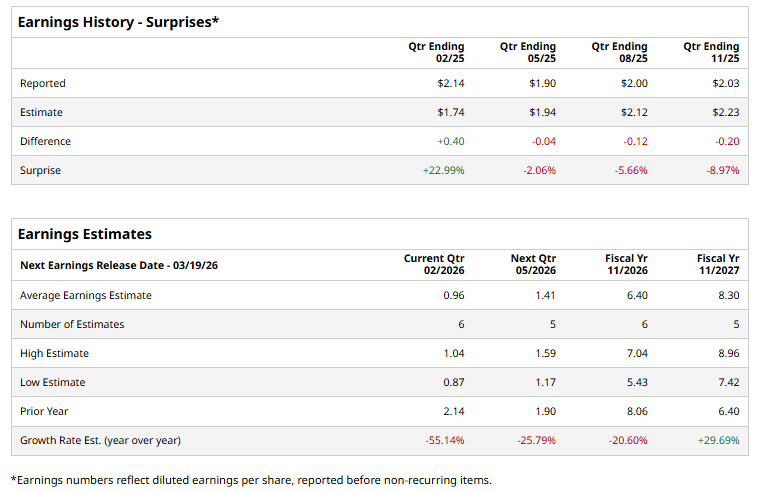

The company is slated to announce its first-quarter earnings results soon. Ahead of this event, analysts project this company to report a profit of $0.96 per share, down 55.1% from $2.14 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in one of the last four quarters, while missing on three other occasions.

For the current year, analysts expect Lennar to report EPS of $6.40, down 20.6% from $8.06 per share in fiscal 2025. Nonetheless, its EPS is expected to rebound in fiscal 2026 and grow by 29.7% year over year to $8.30.

LEN stock has declined 15.7% over the past 52 weeks, considerably underperforming both the S&P 500 Index’s ($SPX) 13.6% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.6% uptick over the same time frame.

On Jan. 21, LEN shares popped 2.5% after the company declared a quarterly cash dividend of $0.50 per share for both Class A and Class B common stock payable on February 19, 2026.

Wall Street analysts are cautious about LEN stock, with an overall “Hold” rating. Among 19 analysts covering the stock, two recommend a “Strong Buy,” nine advise a “Hold,” one “Moderate Sell,” and seven suggest a “Strong Sell.” While the stock is trading slightly above its mean price target of $108.23, the Street-high target price of $154 implies that LEN stock could rally as much as 34.3% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart