The latest headline from UnitedHealth Group (UNH) captured investors' attention for obvious reasons. During a hearing before lawmakers, UnitedHealth Group CEO Stephen Hemsley said that the firm plans to voluntarily rebate any profits made through its Affordable Care Act plans in 2026 because Congress is deciding whether to extend premium tax credits. This development comes at a time when President Donald Trump has repeatedly lashed out at major insurers.

At face value, “rebating profits” appears to be a negative signal to shareholders. However, this needs to be considered in perspective. UnitedHealthcare operates in the individual marketplace in the ACA environment, and this step appears to be a temporary and voluntary choice and not a significant change in the business structure.

However, the market is just as responsive to stories as it is to statistics. Now that the health insurance industry is again in the crosshairs of the federal government, with average increases of more than 25% predicted for the average ACA plan in 2026, it is no wonder that the investing community is wondering if this is the beginning of something bigger.

About UnitedHealth Group Stock

UnitedHealth Group, the biggest health insurer in the U.S., functions under two major business segments: UnitedHealthcare, which offers insurance, and Optum, its rapidly expanding health care service and data analytics business. The corporation is based in Minnetonka, Minnesota, and has a market capitalization of about $307 billion, making it not only a behemoth in the health care industry but also in the S&P 500 Index ($SPX).

Over the past 52 weeks, the stock price of UNH has been quite volatile, oscillating between a low of around $235 and a high of more than $600, before stabilizing lately around $346. Even after the recent correction, the stock price of UNH has shown a remarkable recovery over the past five trading days, rising by 6%. Relative to the S&P 500, UNH has been a poor performer over the past year.

In terms of valuation, it seems that UNH is more reasonable than it has been given credit for. The company trades at a price-to-earnings (P/E) multiple of about 16x and a forward P/E multiple of about 19x, with a price-to-sales (P/S) multiple of only 0.7x. For a firm with strong cash flows, a beta of less than 0.5, and a return on equity of nearly 20%, it seems as if the market is already factoring in a good bit of risk with regards to the political and regulatory environment in which it must operate.

UnitedHealth Group Beats on Earnings Despite Policy Noise

The most recent earnings release for UnitedHealth sheds light on why UnitedHealth’s executives feel they can make gesture statements about profits related to the ACA. In the third quarter of 2025, UnitedHealth had $113.2 billion in revenue, which grew 12% from the prior year, and $2.92 in adjusted EPS, which significantly beat market estimates. The cash flow from operations for the period reached $5.9 billion, which surpassed net income.

The company’s management has also strengthened its full-year outlook for 2025, predicting at least $16.25 in adjusted EPS. More specifically, the medical care ratio of 89.9% came out right on target, indicating there is no underlying issue with the trend of claims. UnitedHealthcare’s revenues are up by 16% on a year-over-year basis, with contributions mainly from Medicare & Retirement, Community & State, along with steady growth at Optum, including Optum Rx.

This diversity is important. It is not in the individual market under the ACA that UnitedHealth Group derives most of its profits. It is Medicare Advantage, the employer market, and Optum’s services network that contribute to the majority of profits. While rebating the margins in the ACA would result in a slight reduction in profits, the trend in profits for the company would not be affected.

What Do Analysts Expect for UnitedHealth Group Stock?

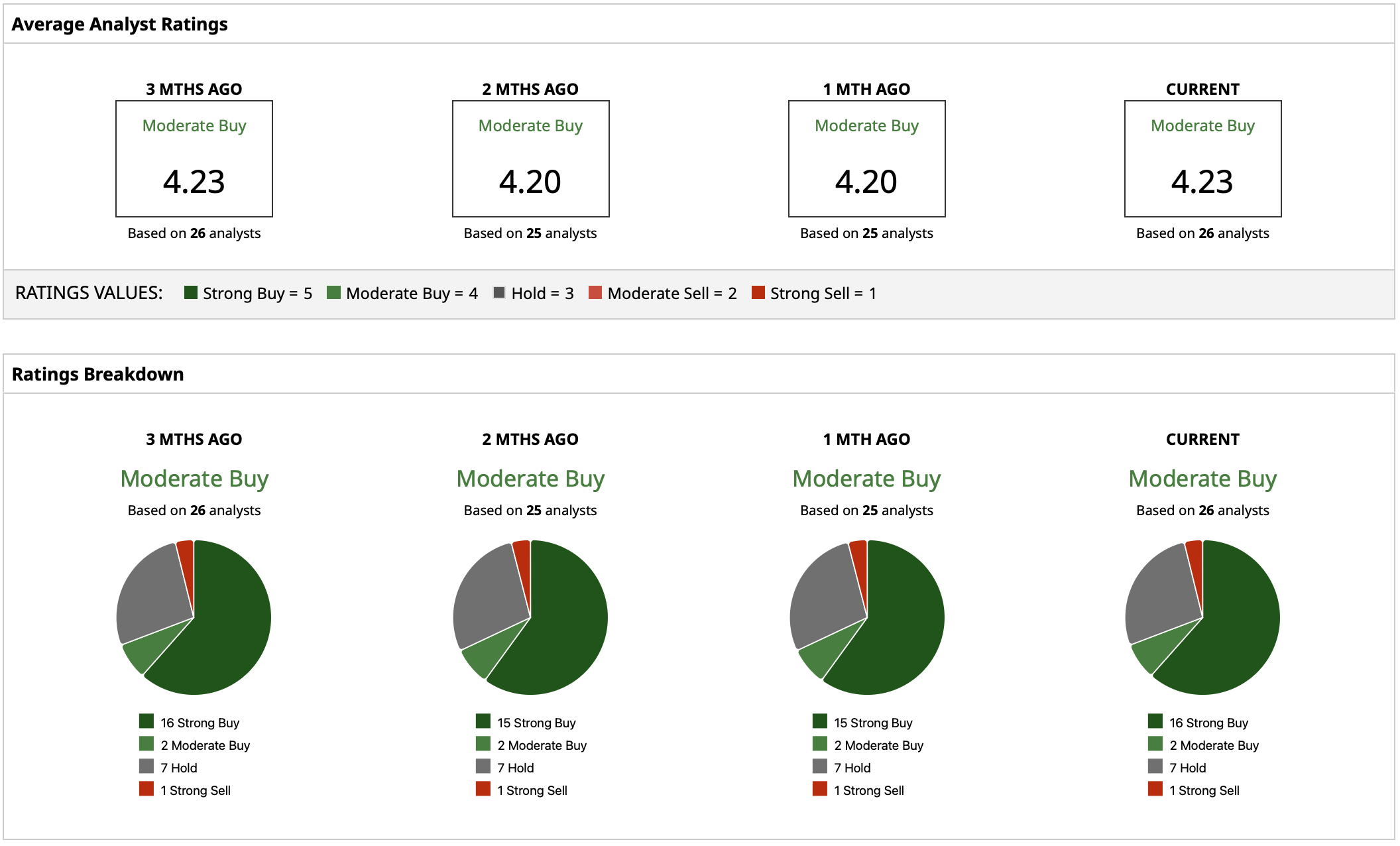

UnitedHealth has a large number of analysts tracking the company, with a “Moderate Buy” consensus rating and a current mean target price of $396.61, which offers a potential gain of about 15% from current market levels. The high-end target of $444 suggests that, if political pressure fades, investors could re-rate the stock closer to its historical multiples.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Power Up for a Larger Rally in 1 of 2026’s Winning AI Stocks with a Bull Call Spread

- UnitedHealth Announces Plans to Rebate ACA Profits. What Does That Mean for UNH Stock as Trump Takes Aim at Insurers?

- As Jensen Huang Preps to Visit China, How Should You Play Nvidia Stock?

- Dear Tesla Stock Fans, Mark Your Calendars for January 28