Heading into 2026, Applied Digital (APLD) finds itself in bad company: it was among the most shorted stocks in the tech sector in December. High short interest is usually a sign that traders believe something is fundamentally wrong with the company or the industry it operates in. For Applied Digital, this development is particularly surprising, as the company seems to be doing a good job of carving out its place in the industry, which itself is expected to continue growing in the near term.

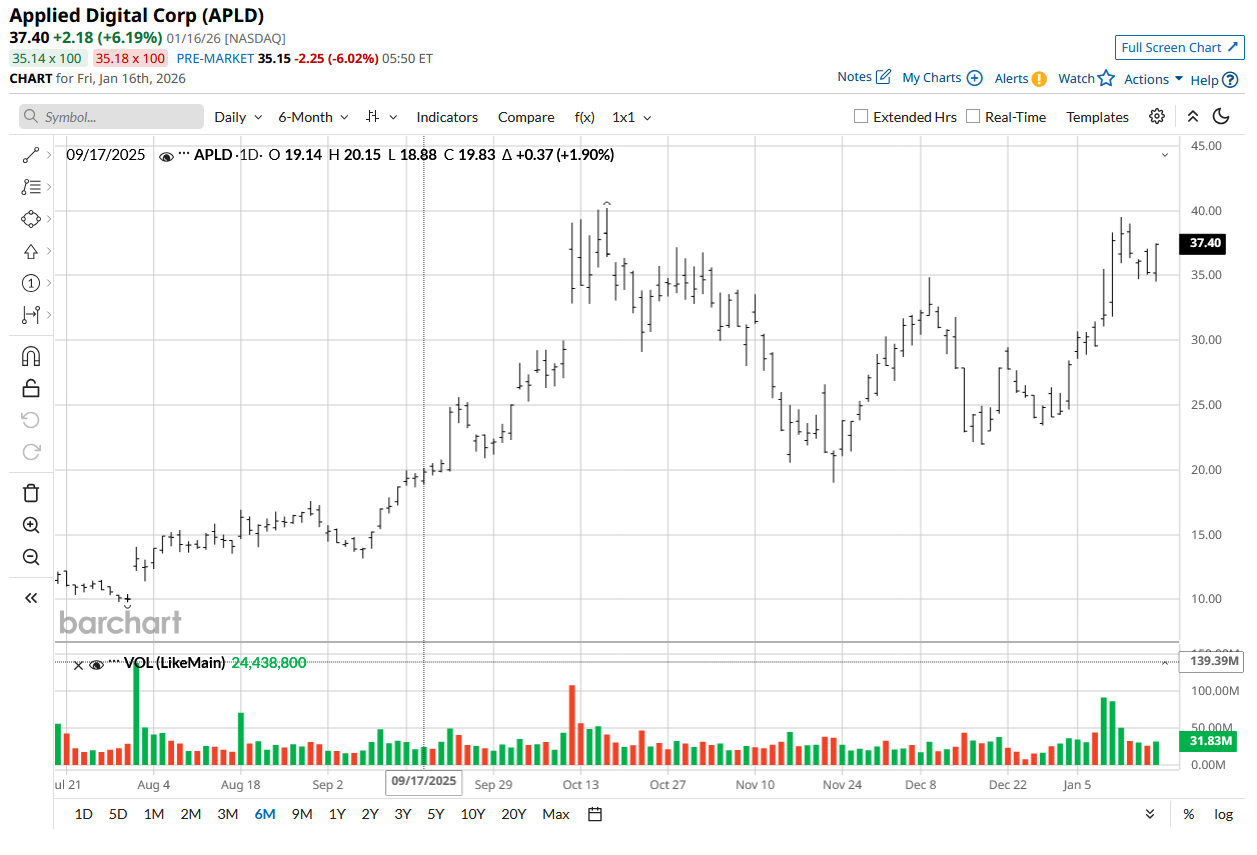

Despite the above, APLD stock has gained 42% year-to-date (YTD). This is because short interest can act as a double-edged sword. The process of borrowing and then selling shares in the market brings the price down. But if a stock keeps going up for some reason, the same traders have to buy back these shares from the market. This generates upward stock price momentum that can then skyrocket if the majority of the traders rush in to close their positions.

For APLD, this trigger arrived on the earnings call earlier this month, and the stock hasn’t looked back since. But is APLD still worth buying? Let’s dive deeper.

About Applied Digital Stock

Applied Digital is based in Dallas, Texas, and designs, builds, and operates digital infrastructure, including data centers. The company specializes in data centers servicing high-performance computing and AI needs.

Over the last year, APLD stock has proven to be a multi-bagger, gaining far more than the S&P 500’s ($SPX) 14% return over the past 52 weeks, up 267% during the same period. In fact, APLD had seen significant gains by October 2025 already, but the arrival of short traders and high valuation resulted in a volatile quarter.

APLD isn’t yet profitable, but the valuation remains high. On a price-to-sales (P/S) basis, the stock is trading at 72.5 times. For a company not yet as fundamentally sound as some make it to be, it's no wonder the stock was being shorted in December.

That isn’t in itself something to be too concerned about. However, if a company is burning cash at an alarming rate, and there is no reliable future cash flow or demand visibility, the risk increases. Data center demand is expected to stay high, but because Applied Digital isn’t an established player in the industry, the risk of it being replaced through a small change in the underlying technology is high. In that case, the firm's net debt will also become a huge liability.

While APLD stock has exciting prospects, the high risk and short interest of 27.27% make it a risky bet.

Applied Digital Rises After Earnings

Applied Digital announced earnings on Jan. 7, and the stock has done well since then. The company reported EPS of $-0.11, which was a wider loss than the estimated loss per share of $0.09. However, APLD still went up in post-market as the company's second-quarter revenue of $126.6 million was up 250% year-over-year (YOY).

Management reported that it had signed two important leases with hyperscalers in North Dakota. It believes a first-mover advantage is helping the company gain even more traction. To that end, another hyperscaler has shown interest in setting up data centers in the Dakotas as well as other U.S. markets. This shows that the company’s expertise is not only proven but also gaining traction among high-value clients. Applied Digital also expects to achieve $1 billion in net operating income within the next five years.

What Are Analysts Saying About Applied Digital Stock?

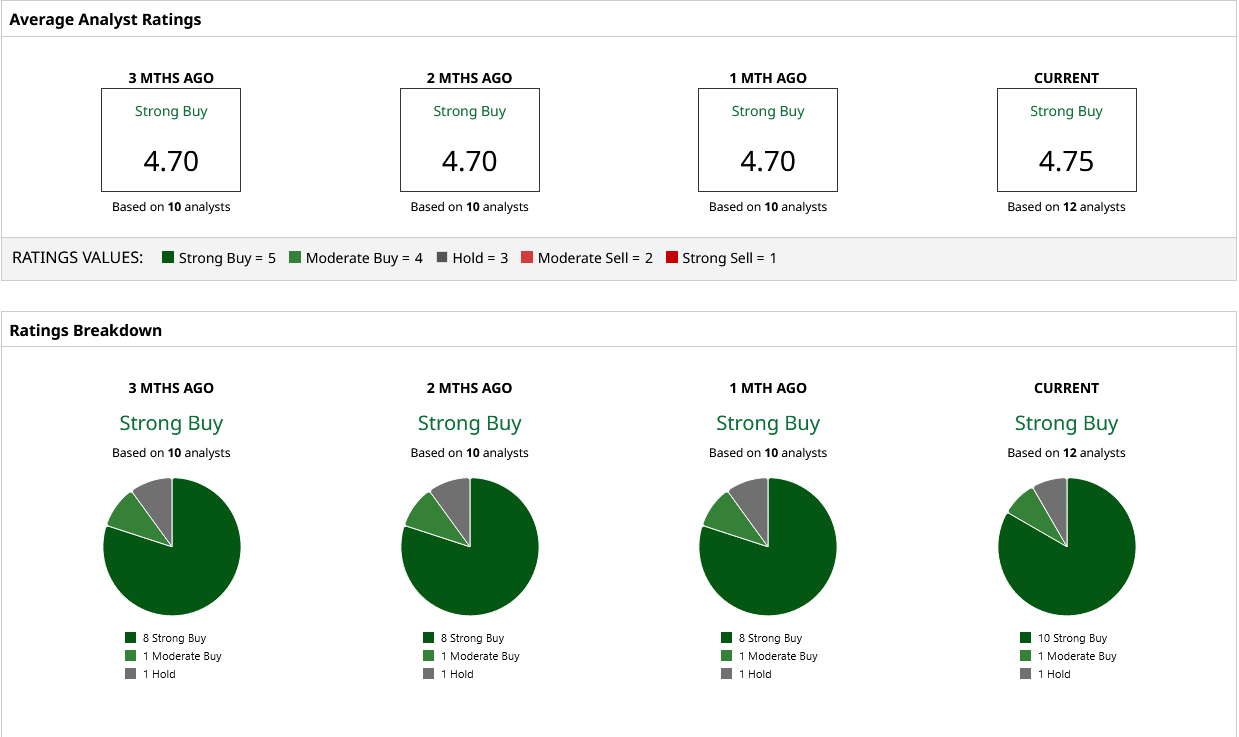

Analysts continue to be bullish on APLD stock, with 10 out of 12 analysts rating it as a “Strong Buy.” The median price target of $48.82 offers 39% potential upside from here, while the highest price target of $99 translates to a whopping 183% gain! The $99 target price was assigned by Arete Research, which initiated coverage on APLD stock on Jan 7. APLD has already risen 18% since that rating, adding to the misery of those who have shorted the stock.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart