When big geopolitical headlines hit, the market often prices in the ending of the story before it’s even started. That’s exactly what’s happening with Venezuela after the U.S. arrested President Nicolas Maduro in a surprise raid earlier this month, effectively undermining the regime’s power structure.

The country holds the world’s largest proven crude oil reserves, but turning that oil into usable barrels isn’t a switch to be flipped on. It’s going to be a long rebuilding process that requires capital, contracts, infrastructure, and security — all of which take time.

In our most recent Market on Close livestream, Senior Market Strategist John Rowland, CMT, made a critical distinction that trigger-happy traders often miss: The immediate opportunity isn’t “buy oil.” It’s “who can process and move Venezuela’s heavy crude first?”

That framing changes everything.

Why Venezuela Matters to Crude Prices (and Why This Isn’t Simple)

Venezuela’s oil story is really two timelines running in parallel.

- Long term, there’s enormous upside potential if international majors return, invest, and scale production. That’s a multi-year process requiring tens — if not hundreds — of billions in capital.

- Short term, it’s a routing and refining story. Where do the barrels go? Who can run them? And who benefits before production meaningfully ramps?

Multiple industry estimates suggest Venezuela needs massive investment just to stabilize current output, and far more to return to historical production levels. And importantly, oil majors aren’t rushing back without iron-clad guarantees.

As John pointed out, the scars from past nationalizations are still very real.

The Trade the Market is Actually Giving You: Heavy Crude Advantage

Venezuelan crude is typically heavy and sour, meaning it’s thicker, higher sulfur, and harder to refine than the light, sweet crude that’s available elsewhere.

That matters because heavy crude usually trades at a discount. Refiners with the right equipment — cokers and hydrocrackers — can buy that discounted oil and still sell gasoline and diesel at market-linked prices. When that setup appears, refining margins can expand quickly.

This is why John emphasized that only a small group of refiners truly benefit when Venezuelan barrels start moving.

Reuters reinforced this point in early January 2026, noting that Gulf Coast refiners with complex assets are uniquely positioned to run Venezuelan crude efficiently.

Why Valero, Phillips 66, and Marathon Matter Here

In the clip, John highlighted refiners that can express a Venezuela thesis without waiting years for upstream investment.

The primary names:

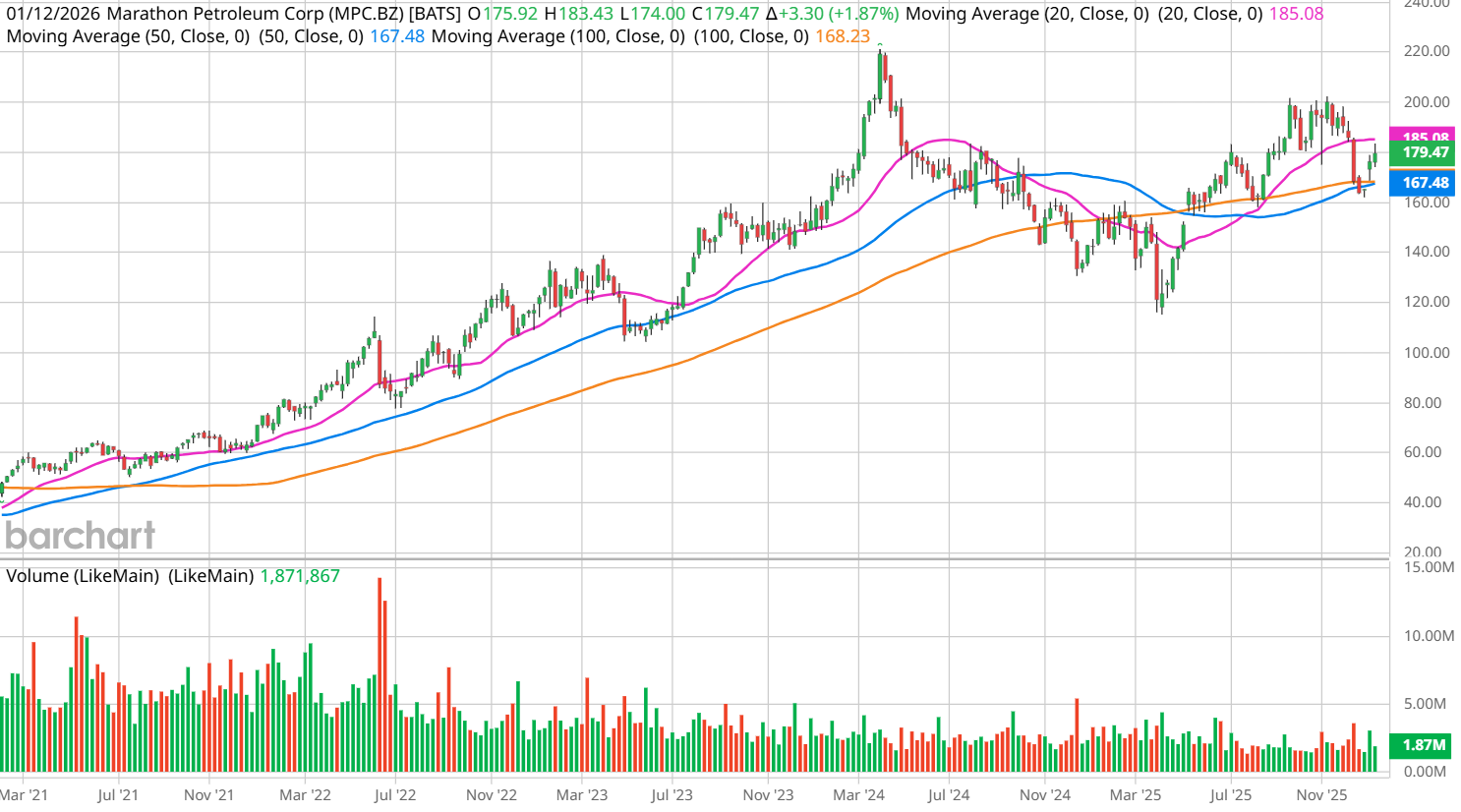

But John also noted an important secondary player that deserves attention: Marathon Petroleum (MPC).

Marathon operates large, complex refining assets capable of handling heavier crude slates. It may not be the headline name in a Venezuela trade, but it fits the same structural profile: scale, complexity, and Gulf Coast exposure.

That’s why this is best viewed as a relative-value and momentum trade, not a political bet.

Oil Majors Reality Check: Exxon Is Out, For Now

One of John’s most important clarifications: not all oil majors benefit equally. Already, Exxon Mobil (XOM) has effectively signaled it’s not prioritizing Venezuela.

Exxon’s capital and focus are currently tied up in Guyana, one of the most significant offshore oil developments globally.

That matters because it reinforces the idea that Venezuela’s recovery won’t be immediate — and that downstream players (refiners and shippers) may see benefits sooner than upstream drillers.

A Piece Most Traders Miss: Shipping Rates & the Security Premium

John added another layer that’s critical to understanding the full setup: shipping.

When crude flows increase out of geopolitically sensitive regions, shipping rates tend to rise for two reasons:

- Increased demand for vessels

- The security premium tied to risk and insurance

That combination can create tailwinds for crude tanker operators — particularly those servicing Gulf Coast routes.

John mentioned a handful of names worth further investigation on this basis:

This isn’t a call to “buy all tankers” or a suggestion for traders to chase these names blindly. Instead, energy investors should watch shipping rates alongside crude flows, because transportation is often the first bottleneck in global oil resets.

How to Turn This Into a Real Trading Framework

Instead of trading on knee-jerk responses to headlines, John’s approach focuses on sequence.

#1. Follow crude prices + the spread that matters.

Crude direction is a starting point, but refiners often trade more on margin dynamics than they do on headline WTI crude price moves. Whatever your crack spread focus, we’ve got you covered.

#2. Build a refinery watchlist tied to heavy crude capability.

Start with VLO and PSX (John’s picks). If you want a smaller-cap add-on from the clip, HF Sinclair (DINO) can also be worth monitoring as a secondary name.

#3. Use levels + confirmation to trade, not feelings.

If you’re trading the breakout/momentum angle, let the chart decide when you act. Regardless of how strong the stock’s narrative is, key price points and multiple indicators should confirm trend strength and direction.

#4. Keep the timeline appropriate.

Near-term, track catalysts like flows, routing, and margins. Longer-term, pay attention to capital investment, contract stability, and production scaling.

The Bottom Line

The oil story developing out of post-Maduro Venezuela isn’t an overnight supply shock; it’s a process:

- Upstream recovery takes years and capital.

- Refiners benefit earlier if heavy crude availability improves.

- Shippers may see tailwinds as flows and security premiums rise.

That’s why John’s read is sharp: while the world debates geopolitics, traders should focus on who can process and move the barrels first:

Stay on top of the Venezuela investment thesis as it develops by signing up to be alerted when Market on Close goes live, and subscribing to Barchart’s free daily Commodity Bulletin.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Trump-Linked Penny Stock Just Regained Nasdaq Compliance. Should You Buy It for 2026?

- Cathie Wood Is Buying Up Roblox Stock. What Is the Bull Case for RBLX in 2026?

- Intel Stock Just Got a New Street-High Price Target. Should You Buy INTC Here?

- Unusual Options Activity: 3 Multi-Leg Trades to Watch — SHOP, SBUX, and PINS