Intel (INTC) stock surged 10% on Friday following a White House meeting between CEO Lip-Bu Tan and President Donald Trump, who declared the United States government was “proud to be a shareholder” of the struggling chipmaker.

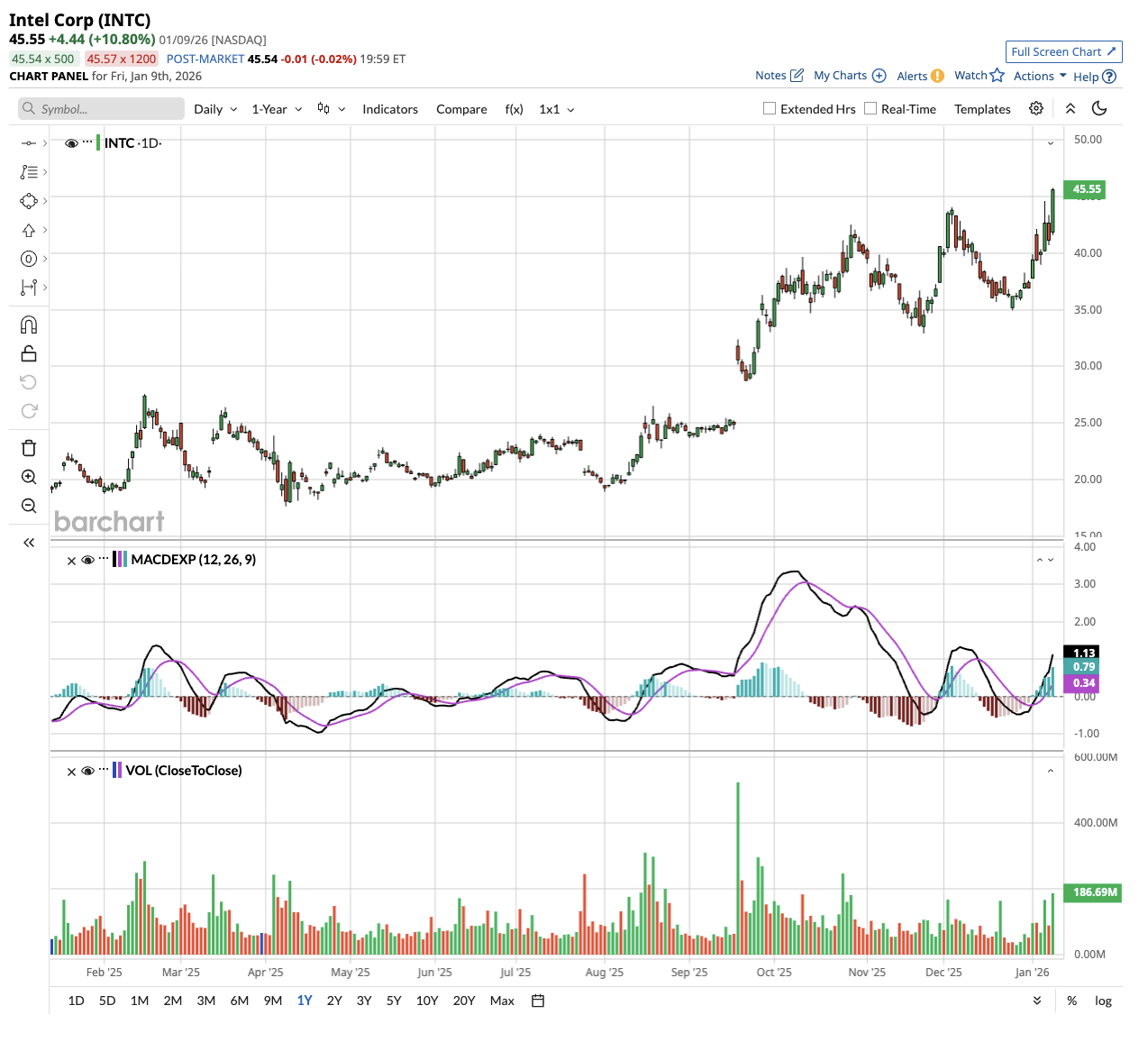

The rally extends a remarkable turnaround that has seen INTC stock more than double since the federal government injected $8.9 billion into the chipmaker last August through the CHIPS and Science Act, acquiring a 10% stake at $20.47 per share.

Trump's enthusiastic endorsement on Truth Social praised Tan as “very successful” and highlighted Intel's latest Core Ultra Series 3 processors, emphasizing they were designed, built, and packaged entirely in America.

The timing is politically convenient as the administration pushes domestic semiconductor manufacturing, though the federal investment has already generated unrealized profits exceeding $10 billion, with shares closing at $45.55. Just a few months back, Trump demanded Tan’s resignation over alleged conflicts of interest stemming from the CEO's connections to Chinese companies.

Tan was appointed as Intel CEO in March 2025 amid falling sales and instability under predecessor Pat Gelsinger. Moreover, Tan defended his four-decade career in the industry and pledged to operate within the highest ethical standards.

The broader semiconductor sector rallied alongside Intel, as Broadcom (AVGO), ASML (ASML), and Micron (MU) moved higher. Will the government backing help Intel navigate competitive challenges and lay the foundation for sustainable recovery over the next decade?

The Bull Case of Investing in INTC Stock

Intel faces a critical inflection point as new CEO Lip-Bu Tan drives aggressive cultural transformation while wrestling with severe supply constraints across both client and server markets. The company's stock volatility reflects uncertainty about whether manufacturing improvements and strategic partnerships can restore competitiveness against AMD and ARM-based alternatives that have steadily eroded market share.

The immediate challenge involves ramping up production of Panther Lake, Intel's first major product built on the troubled 18A manufacturing process. The first Panther Lake chips shipped by year-end, with broader availability expected in Q1 of 2026.

Supply tightness has emerged as an unexpected near-term benefit concealing deeper competitive concerns. Strong demand from hyperscale customers seeking long-term supply agreements for traditional servers caught Intel by surprise.

Intel is shifting internal manufacturing capacity from client to server products while undershipping both markets. The semiconductor giant expects supply constraints to peak in Q1 before improving over the next 12 months.

The strategic partnership with Nvidia (NVDA) provides crucial validation for Intel's x86 ecosystem. Nvidia will invest $5 billion and collaborate on custom server processors integrating NVLink fabric for AI workloads, as well as on client processors.

This multigenerational agreement required extensive engineering evaluation of Intel's roadmap, indicating that NVIDIA found competitiveness improving despite current challenges. The bailment structure for client graphics avoids margin-dilutive pass-through costs similar to Lunar Lake's embedded memory. Longer-term viability depends on landing external foundry customers for the 14A process node, expected in late 2026 or early 2027.

Management emphasized that 14A development benefits from earlier customer engagement during the definitional phase compared to 18A. Until external revenue materializes, Intel Foundry targets operating profit breakeven in 2027 primarily through internal product ramps.

What Is the INTC Stock Price Target?

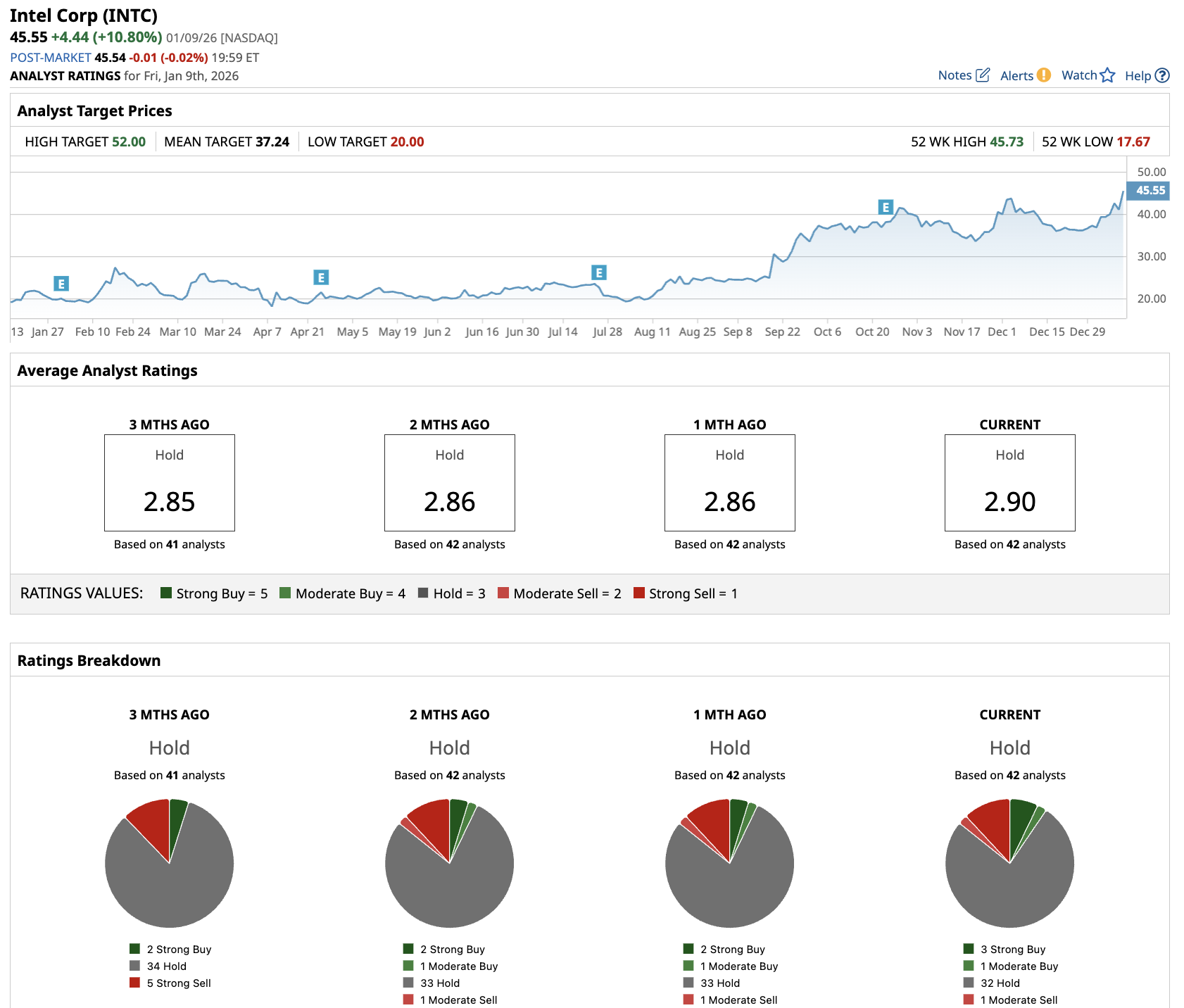

Analysts tracking INTC stock forecast adjusted earnings to grow from $0.34 per share in 2025 to $2.84 per share in 2029. If the tech stock is priced at 25x earnings, which is reasonable given its growth estimates, it should trade around $70 in late 2028, indicating an upside potential of 55% from current levels.

Out of the 42 analysts covering INTC stock, three recommend “Strong Buy,” one recommends “Moderate Buy,” 32 recommend “Hold,” one recommends “Moderate Sell,” and five recommend “Strong Sell.” The average Intel stock price target is $37, below the current price of $45.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart