Intel’s (INTC) turnaround and manufacturing ambitions were dealt a severe blow when Nvidia (NVDA) decided to halt its trial of the 18A manufacturing technology. Touted as the technology that will help Intel turn its business around, the 18A is a 2 nm chip technology that offers superior power efficiency and chip density. Nvidia’s involvement was taken as a positive signal by many, but that optimism has faded away since this announcement.

The timing of this news is interesting in the context of Nvidia’s $5 billion investment in the company back in September. Having the backing of the largest chip designer in the world was considered a vital part of Intel’s recovery. However, investors are now finding out that this was possibly a purely financial decision, and there were no guarantees that Nvidia would either help in or promise to utilize Intel’s technologies for its manufacturing. As things stand, NVDA is clearly looking at alternatives.

Intel now needs to go back to the drawing board and figure out the answer to an important question: how does it develop an attractive, high-yield manufacturing process and win large single customers? Unless it can figure out the answer quickly, a revival would be extremely difficult, if not impossible.

About Intel Stock

Intel is a leading semiconductor company that not only designs but also manufactures semiconductor chips for PCs, data centers, and other computing applications. It was founded in 1968 and is headquartered in Santa Clara, California.

Intel’s stock has lost almost 18% of its value since early December, when it hit a 52-week high of $44.01. However, its YTD performance of 87% comfortably outperformed the PHLX Semiconductor Index’s 44.7% performance. Much of this happened on the back of the support provided by President Donald Trump and the U.S. government, which boosted investor confidence.

Despite the poor stock performance in November, Intel stock is still pricing in a lot of future success and therefore looks overvalued. It continues to trade at a non-GAAP forward P/E of 106.48x, which is more than its own 5-year average of 48.17x. The company’s TTM price-to-book value ratio is nearly the same as the 5-year average of 1.63x, though. In fact, it is less than half the sector’s average, which means the stock is trading at a considerable discount to its peers. In the absence of a dividend, INTC stock still seems a risky bet, especially considering how Nvidia just pulled out of a manufacturing node that was a major part of Intel’s recovery plan.

Intel’s Revenue Surprised Analysts in Q3

Intel announced its Q3 2025 earnings report on Oct. 23 and surprised investors with a better-than-forecast sales number. The revenue of $13.65 billion comfortably beat estimates of $13.14 billion. In the ongoing quarter, Intel expects $13.3 billion in revenue, with an EPS of $0.08.

One of the most noticeable improvements in the company’s finances in Q3 was the cash flow strength. Intel was able to secure an $8.9 billion investment from the U.S. government. Another $2 billion from SoftBank (SFTBY) and a promise of $5 billion investment from Nvidia made it a great quarter for Intel in terms of cash flow. The $5 billion investment was confirmed earlier on Monday, though investors would have loved to receive it with more positive news on the 18A manufacturing front.

What Analysts Are Saying About INTC Stock

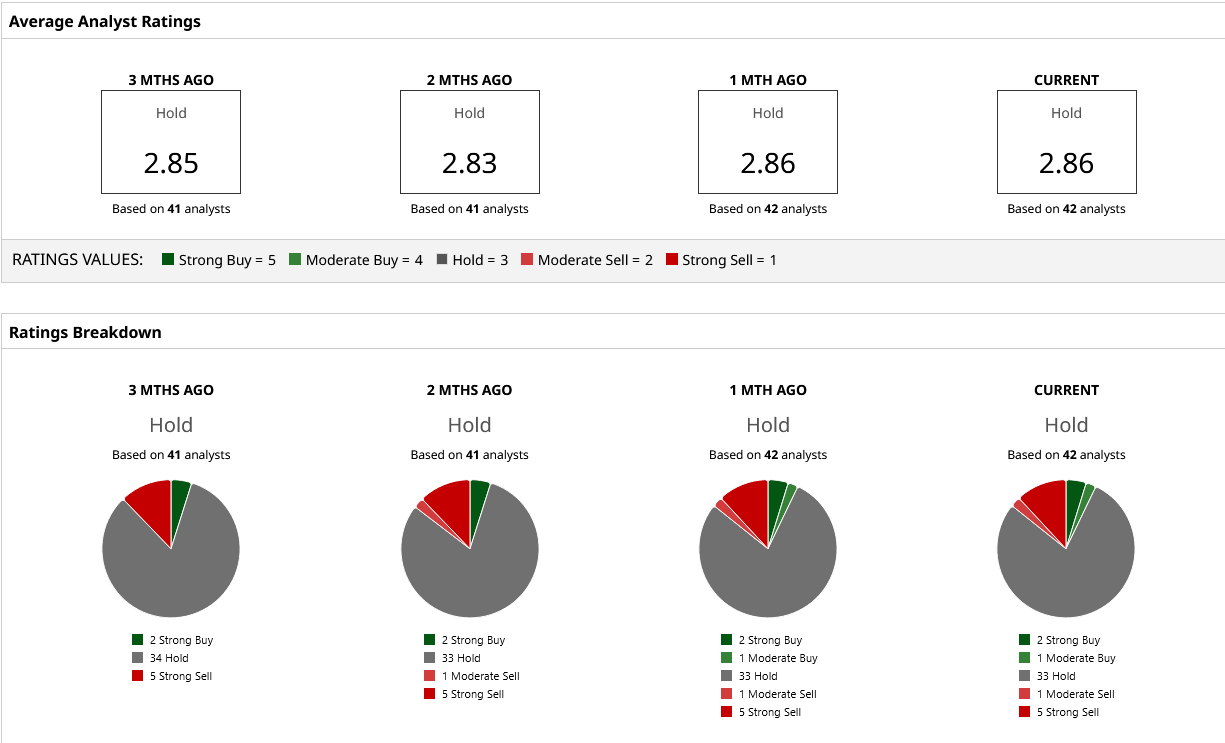

INTC is covered by 42 analysts on Wall Street. The negative sentiment around the stock continues to persist with five “Strong Sell” ratings. This is rare for semiconductor stocks, which usually tend to have no sell ratings thanks to the high-growth rates of associated technologies and industries. But Intel continues to be an exception; that’s how bad things have been for the company. The lowest price target of $20 could see the stock go to the same levels as before Donald Trump took over. The highest price target of $52 offers 44% upside, though it is quite possible investors and analysts reconsider their opinions in the coming days.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- New China Subsidies Are Lifting the Bull Case for Nio Stock Today. What the Data Tells Us for 2026.

- As Nvidia Reportedly Snubs the Intel 18A Process, How Should You Play INTC Stock for 2026?

- These 10 Stocks Are All Up More Than 99% in 2025. 3 of Them Look Likely to Keep Going Higher.

- Is One Asset Screaming that Stocks are Cheap Going into 2026? Can the S&P 500 Reach 10,000 in 2026?