Sidus Space (SIDU) stock more than doubled on Dec. 22 after the space and defense-tech company secured a spot in the U.S. government’s $151 billion “SHIELD” program.

“This milestone reflects our ability to deliver integrated solutions across multiple domains,” said Carol Craig, the firm’s chief executive in a press release on Monday.

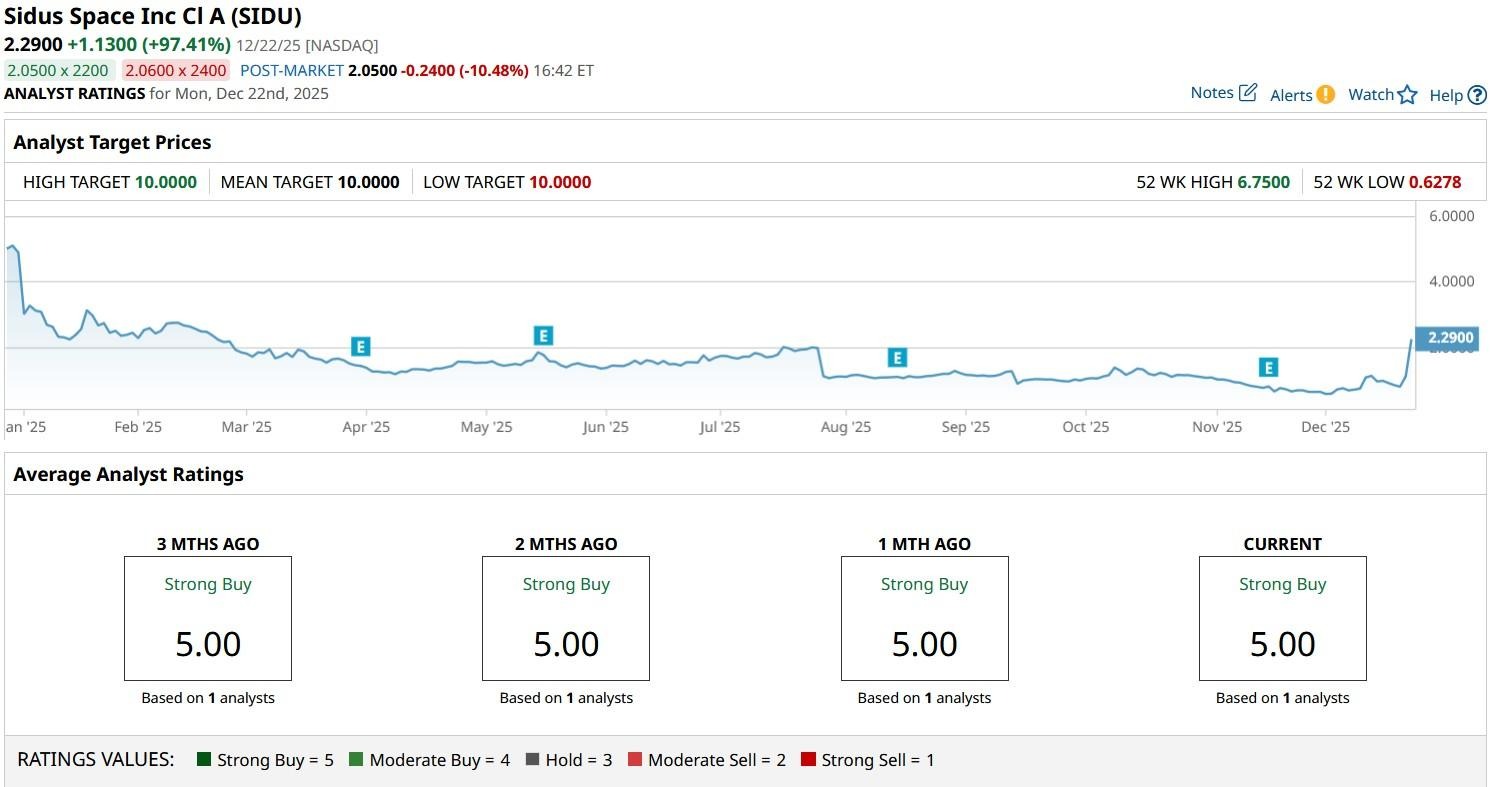

Despite the explosive rally, Sidus stock remains down some 70% year-to-date.

Why Does SHIELD Participation Matter for SIDU Stock

The Missile Defense Agency’s contract is largely positive for SIDU shares as it validates the firm’s defense-tech capabilities and boosts its visibility into future revenue.

The award positions Sidus Space within a massive, multi-year federal initiative, making its stock infinitely more attractive for institutional investors.

For the Nasdaq-listed firm, participation in the SHIELD program means a major dose of credibility that opens doors to strategic partnerships and future contracts.

In short, investors cheered the announcement mostly because it signals stable funding and growth potential, reducing concerns about sustainability.

This prospect of transformative scale in the years ahead is what drove SIDU higher on Monday.

Are Sidus Space Shares Worth Owning Heading Into 2026?

SIDU stock is worth owning heading into 2026 also because the management is positioning it as a niche player within the fast-growing space and defense technology sector.

It’s not just government support. The Florida-based company has catalysts tied to satellite launches and payload services as well.

Despite operational challenges, its micro-cap valuation leaves room for outsized gains if execution improves and contract wins accumulate.

From a technical perspective, the picture is just as attractive. Sidus Space is now trading decisively above its key moving averages (50-day, 100-day, 200-day), suggesting the bullish momentum is likely here to stay.

How High Could SIDU Fly Next Year?

For some investors, a glaring red flag on Sidus Space shares may be the absence of extensive Wall Street coverage.

At the time of writing, SIDU stock receives coverage from just one investment firm only. But you could take heart in the fact that it at least has a $10 price target on it, indicating potential upside of nearly 520% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- If You Were Gifted $10,000 of Nvidia Stock Last Christmas, Here’s How Much It Would Be Worth Today

- Virgin Galactic Stock Is Challenging This Key Resistance Level as Trump Goes All In on Space

- Should You Buy FJET Stock After the Starfighters Space IPO?

- As Silver Prices Hit New Record Highs, Should You Buy Hycroft Mining Stock?