D-Wave (QBTS) shares rallied as much as 20% on Monday after the quantum computing company announced plans of participating in the CES 2026 scheduled for Jan. 7.

According to its press release, QBTS will showcase “its award-winning technology and real-world customer success stories” at the world’s largest annual technology trade show.

Additionally, a vice president of the NYSE-listed firm – Murray Thom – will discuss “potential for synergy between quantum computing, artificial intelligence (AI), and blockchain” at the event.

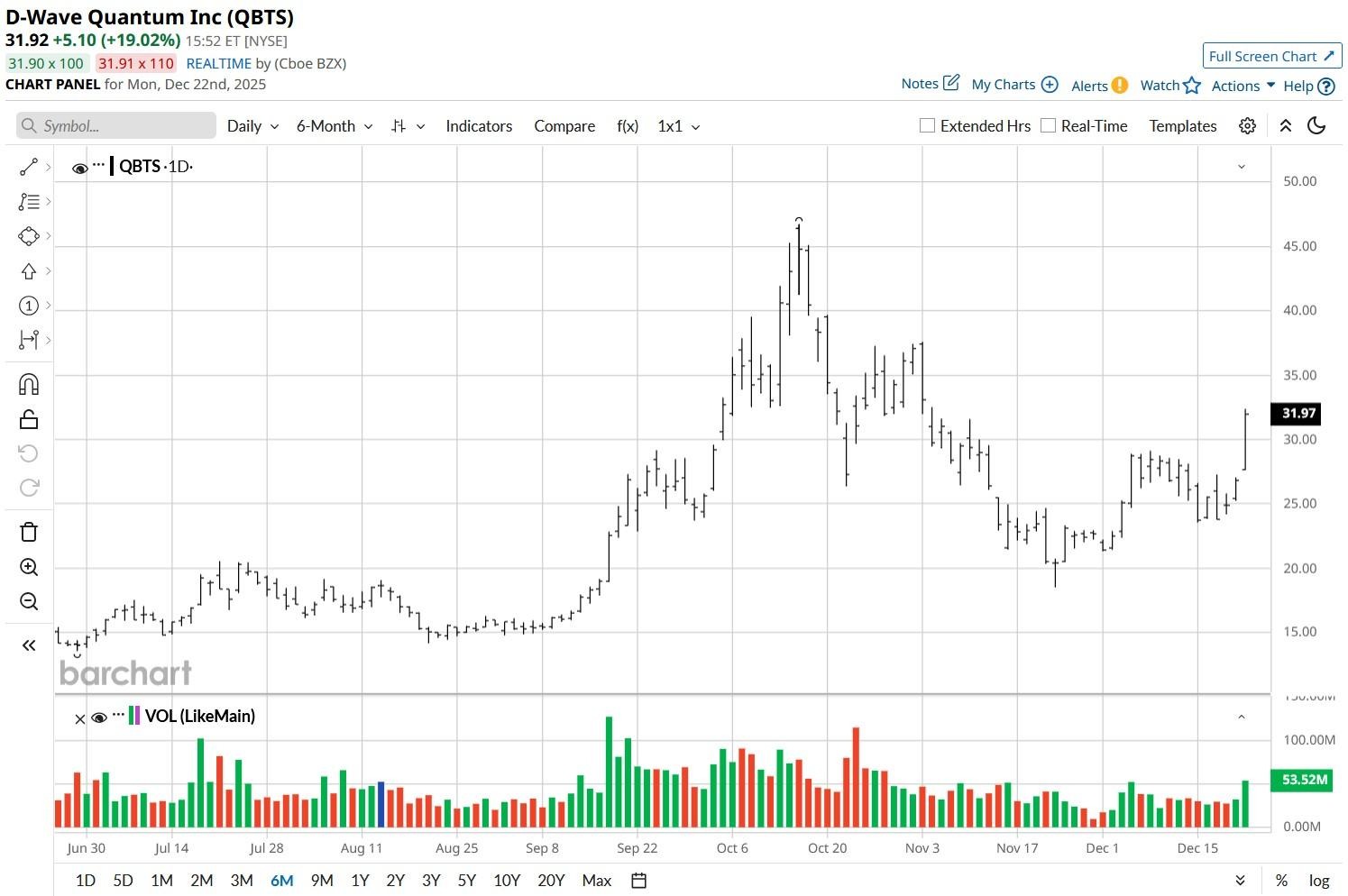

Despite Monday’s surge, D-Wave stock is down more than 35% versus its year-to-date high in mid-October.

Why CES Participation Is Positive for D-Wave Stock

The annual CES conference is a massive opportunity for D-Wave to spotlight its quantum tech on a global stage, boosting visibility with both investors and potential customers.

Showcasing real-world success stories will validate commercial traction, while Thom’s discussion will highlight growth opportunities in high-demand sectors like AI and blockchain.

All in all, the company’s participation in the trade show on Jan. 7 could boost market confidence, positioning QBTS stock as a leader in next-gen computing.

Heading into 2026, Jefferies analysts have a “Buy” rating on D-Wave with a price target of $45, indicating potential upside of another 41% from here.

Why Is Jefferies’ Bullish on QBTS Shares for 2026?

Jefferies remains constructive on D-Wave shares mostly because the Palo Alto-headquartered firm is the only pure-play that’s publicly claimed quantum supremacy.

QBTS’ technology (quantum annealing) is already commercially mature and the over $800 million it has in cash offers meaningful leeway for growth and innovation.

Plus, continued adoption in quantum computing more broadly could serve as a significant tailwind for D-Wave as well.

According to Jefferies’ analysts, the company will grow its revenue at a compound annualized rate of 73% through the end of this decade.

What’s the Consensus Rating on D-Wave Quantum?

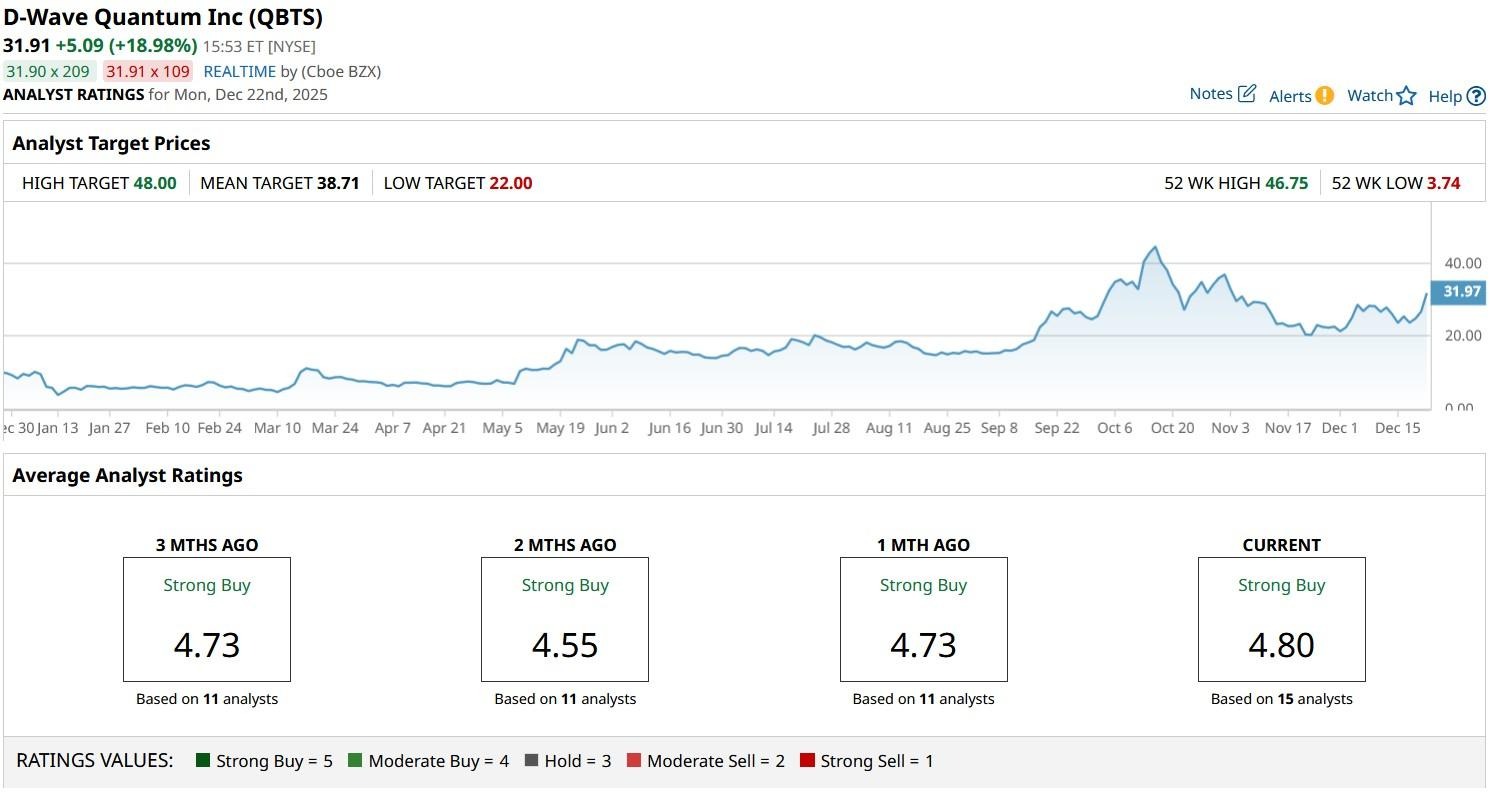

Other Wall Street analysts seem to agree with Jefferies’ bullish stance on QBTS shares as well.

According to Barchart, the consensus rating on D-Wave stock remains at “Strong Buy” with price targets going as high as $48, indicating potential for a more than 65% rally in the coming year.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- If You Were Gifted $10,000 of Nvidia Stock Last Christmas, Here’s How Much It Would Be Worth Today

- Virgin Galactic Stock Is Challenging This Key Resistance Level as Trump Goes All In on Space

- Should You Buy FJET Stock After the Starfighters Space IPO?

- As Silver Prices Hit New Record Highs, Should You Buy Hycroft Mining Stock?