Of late, Palantir (PLTR), the Alex Karp-led AI darling, has suddenly come into the crosshairs of many. Whether it is the valuation skeptics who gasp at the heady levels the company's stock is trading at or the famed short-seller Michael Burry, who, along with valuations, has raised doubts about the company's ability to effectively monetize its commercial operations. Burry has also put a spotlight on the fact that the bulk of Palantir's revenues continues to be derived from the government.

And this is where the latest salvo has come from.

A group of nine Democratic lawmakers have shot off letters to the inspector generals of the Department of Homeland Security and the Department of Defense, raising concerns about the closeness of some companies like Palantir with the current administration at the White House.

“To ensure that federal contracts are free from conflicts of interest and above reproach, we ask that the Department of Homeland Security and Department of Defense Offices of Inspector General investigate the nature of the ties between DHS and DoD immigration contractors and Trump officials, whether officials have improperly assisted such companies in securing government contracts, and whether they have bypassed the standard procurement process to do so.”

The lawmakers also highlighted that several prominent members of the Trump administration hold shares of Palantir, including Deputy Chief of Staff Stephen Miller, as well as his policy advisor, Kara Frederick.

So, is this enough to halt the Palantir juggernaut? Not really, and here's why.

Numbers Don't Lie

Naysayers may point towards Palantir's punchy valuations, but the stock has been a bona fide multibagger for retail investors, gifting them almost private equity-like returns since its IPO in late 2020, with the stock rocketing by 1,942.5% in this period. In 2025, the PLTR stock is up 142% on a year-to-date (YTD) basis.

Moreover, Palantir's quarterly earnings have beaten Street expectations consecutively for more than two years, with the latest one being no exception. In Q3 2025, the company reported a beat on both revenue and earnings. At $1.2 billion of total revenues, Palantir's topline grew by 63% from the previous year. Within this, the U.S. government revenue increased by 52% from the prior year to $486 million, while, and this is where the lawmakers should take a look, U.S. commercial revenue more than doubled to $397 million. In fact, Palantir recently announced a partnership with Nvidia (NVDA), and its private-sector client growth continues to accelerate.

Earnings per share of $0.21 also doubled from the prior year's figure of $0.10 per share, outpacing the consensus estimate of $0.17. This marked the ninth consecutive quarter of earnings beat from the company.

Meanwhile, the customer count grew by 45% from the previous year, and the total contract value soared by a much sharper 151% over the same period to $2.76. Solid rise on both fronts represents clarity of demand and revenue visibility.

Notably, for the first nine months of 2025, net cash from operating activities was $1.36 billion, up from $693.5 million in the year-ago period, as the company closed the quarter with a cash balance of $1.62 billion, dwarfing the short-term debt levels of just $46.3 million.

Lastly, the company raised its full-year 2025 revenue guidance. Palantir now expects revenue to be in the range of $4.396-$4.400 billion, higher than its previous range of $4.142 billion and $4.15 billion.

Why Palantir Is Likely to Keep Winning

Palantir has built a sizeable moat around it, which will be difficult to penetrate. Palantir’s three core platforms—Gotham, Foundry, and AIP—integrate seamlessly with each other, letting customers build end-to-end AI/decision systems without stitching together dozens of tools. This vertical integration is rare in enterprise software. Further, Palantir’s platforms run core operational systems for governments, militaries, energy companies, manufacturers, hospitals, and large enterprises. Once installed, these systems create very high switching costs, multi-year contracts, strong renewal rates, and expansion revenue.

Notably, Gotham, Foundy, and AIP each provide distinct advantages to their respective users and are almost unmatched among their peers. While no other commercial product other than Gotham is as deeply embedded in U.S. and allied intelligence, defense, counterterrorism, and battlefield operations, signifying its mission-criticality, Foundry turns messy enterprise data into a living, contextual model of the business, not easily replicable by rivals. Whereas AIP is Palantir’s fastest-growing product and the main driver of recent hyper-growth, sitting inside business processes while offering a model-agnostic architecture. It also allows safe agentic AI in highly regulated environments, preventing hallucinations, unauthorized actions, and propagation of bad decisions, thus addressing the critical issue of how to safely integrate AI into real operations.

Moreover, Palantir has rolled out three major deals recently that have strengthened its franchise considerably.

The standout is a $448 million Navy program called ShipOS. Palantir is essentially building a unified “operating system” for American shipyards, pulling together data from dozens of contractors and suppliers so the U.S. can close the gap with China’s far faster naval construction pace.

Next came a ten-year, $10 billion enterprise-wide award from the U.S. Army. Instead of the Army managing 75 separate Palantir contracts, everything is now bundled under one vehicle, which removes layers of paperwork and lets the company push new tools to units much faster.

Finally, Palantir deepened its tie-up with Nvidia (NVDA) and CenterPoint Energy through the Chain Reaction initiative. The goal is to clear the logjams slowing AI data center buildout, like old grids, lengthy permitting, and skyrocketing power demand. By layering Palantir’s software on top of Nvidia hardware and CenterPoint’s utility footprint, the partners can spot bottlenecks early, optimize load balancing, and shave months or years off project timelines.

Taken together, these wins lock in long-duration revenue, widen Palantir’s moat inside the defense establishment, and give it a seat at the table for the most capital-intensive part of the AI buildout cycle.

However, all these moats and networking capabilities don't really justify the stock's current valuations. The stock is trading at a forward P/E, P/S, and P/CF of 251.21, 98.36, and 223.92, all much higher than the sector medians of 24.27, 3.55, and 0.55, respectively. Not only this, its PEG ratio, which takes into account the company's superlative growth rates, is at 3.63 on a TTM basis, compared to the sector median of 0.99.

Analyst Opinion

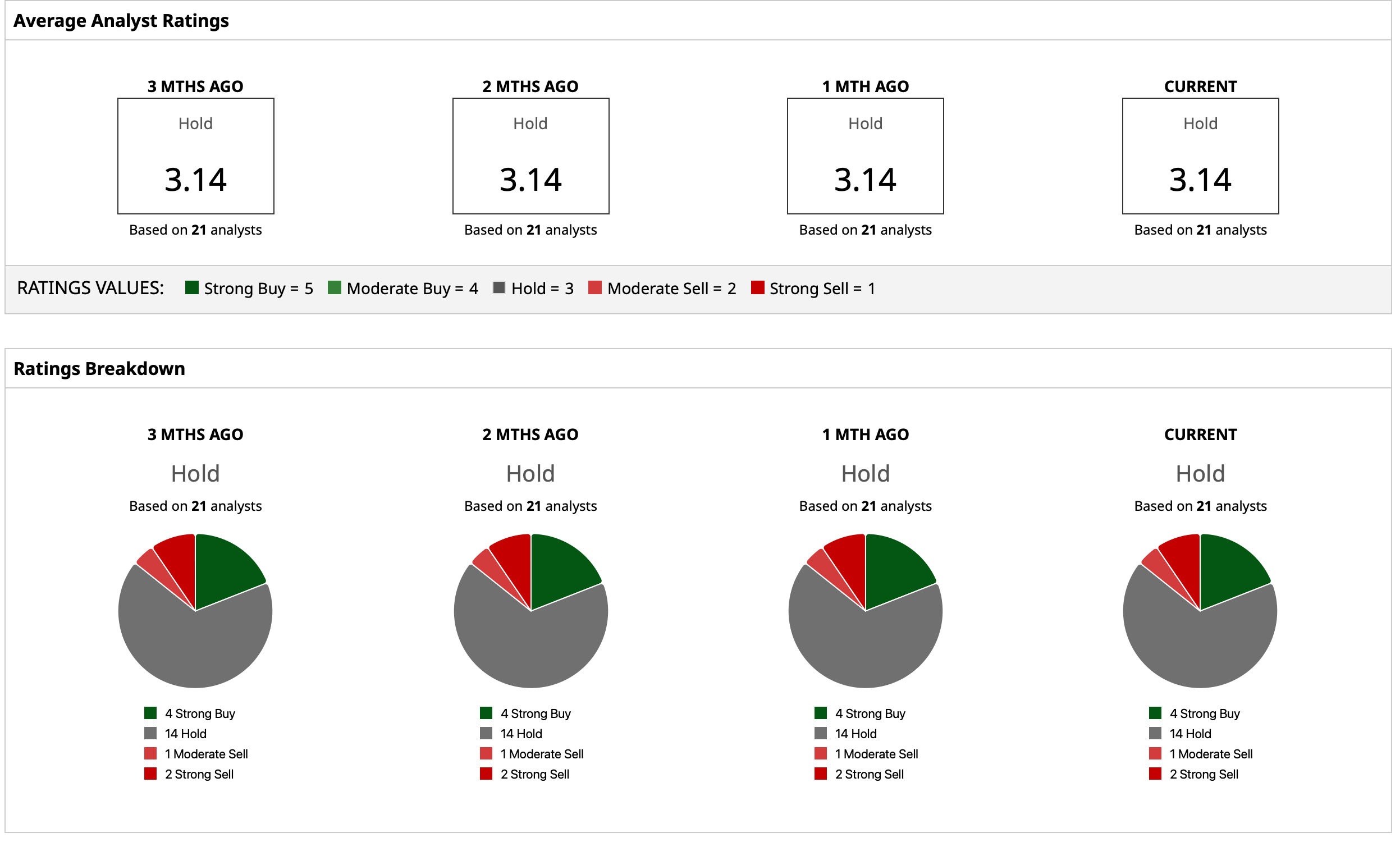

Thus, analysts have deemed the stock a “Hold,” with a mean target price of $192.67. This denotes an upside potential of about 5% from current levels. Out of 21 analysts covering the stock, four have a “Strong Buy” rating, 14 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Carvana Stock Is Joining the S&P 500. Should You Buy Shares Now?

- AeroVironment Is Supposed to Be the Next Palantir, But Its Earnings Disappointed in Q2. How Should You Play AVAV Stock?

- How Fast Does an AI Chip Depreciate, and Why Does It Matter for Nvidia Stock?

- Avocado and AI: How Would a New Model from Meta Platforms Influence the Bull and Bear Cases for META Stock?