Nvidia's (NVDA) latest earnings report indicated that the chipmaker continues to grow rapidly, driven by strong demand and an expanding addressable market. The tech behemoth’s performance sent a clear signal that Taiwan Semiconductor Manufacturing Company (TSM) should also benefit from the ongoing artificial intelligence boom.

According to Wedbush Securities analyst Matt Bryson, Nvidia's results are a green flag for TSMC. Bryson noted that demand for the foundry's advanced manufacturing processes remains fully intact. Moreover, the momentum driving AI chip orders shows no signs of slowing down, which bodes well for TSM’s long-term growth.

Bryson raised his price target on Nvidia to $230 from $210 while maintaining an “Outperform” rating on the stock. He emphasized that the entire hardware sector, including commodity component makers, stands to benefit from Nvidia's trajectory.

These suppliers have enjoyed strong pricing trends, driven by AI-driven demand that continues to exceed expectations. Limited production capacity means this pricing strength should persist as long as AI demand holds up.

The Bull Case for TSM Stock

Taiwan Semiconductor’s Q3 results reinforced its position as the essential enabler of the artificial intelligence revolution. The world's leading contract chipmaker reported revenue of $33.1 billion, slightly above guidance, driven by strong demand for its most advanced manufacturing processes. TSMC also raised its full-year 2025 revenue growth outlook to close to the mid-30s percent range, up from previous expectations.

TSMC's capacity planning process demonstrates why the company remains the trusted partner for the world's leading chip designers. The foundry works with over 500 customers across all end markets, with engagement lead times now extending two to three years in advance for complex processes.

This gives TSMC a 360-degree view of semiconductor demand in the industry. Management employs multiple teams using both top-down and bottom-up approaches to assess market needs and determine appropriate capacity builds.

The company's financial performance remains exceptional, with gross margins reaching 59.5% in the third quarter, exceeding guidance by 200 basis points. TSMC now expects fourth-quarter gross margins around 60% at the midpoint. Notably, the dilution from overseas fab ramp-ups is tracking better than expected, closer to 2% in the second half of 2025, compared to previous estimates of 2% to 3%.

On the technology front, TSMC's 2-nanometer process remains on track for volume production this quarter, with a faster ramp expected in 2026, fueled by both smartphone and AI applications.

The company also introduced A16, featuring its best-in-class Super Power Rail technology, targeting specific high-performance computing products, with volume production scheduled for the second half of 2026.

Advanced packaging revenue is approaching 10% of total revenue, becoming increasingly critical for customers focused on system-level performance rather than individual chip capabilities alone.

Is TSM Stock Still Undervalued?

Over the last decade, TSM stock has returned 1,140% to shareholders after accounting for dividend reinvestments. However, the company’s growth story is far from over, given its forecast to increase revenue from $87.88 billion in 2024 to $209 billion in 2029.

In this period, free cash flow is forecast to improve from $26.4 billion to $90.50 billion. If TSM stock trades at 25 times forward FCF, which is reasonable, it should gain over 90% over the next three years.

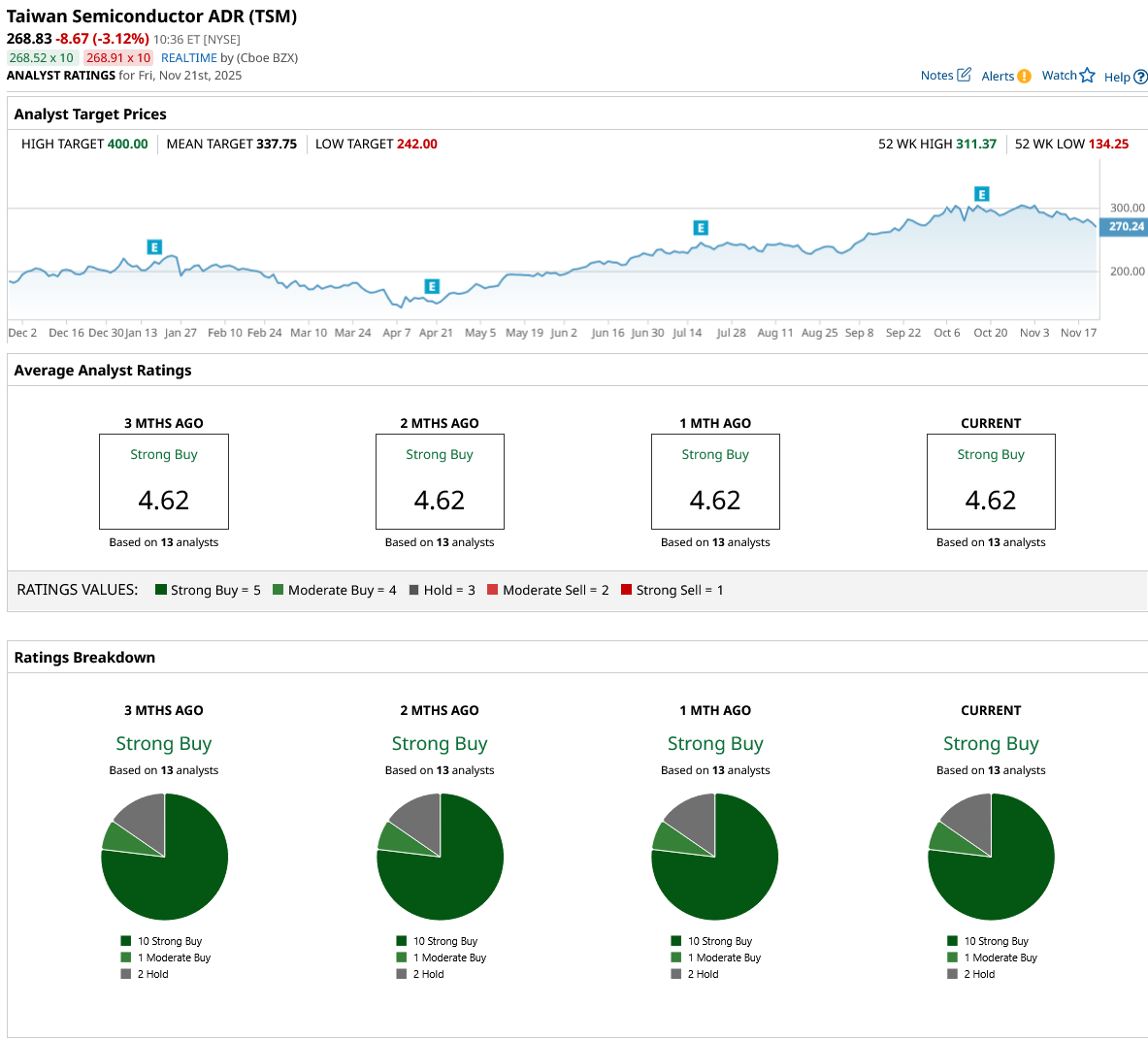

Out of the 13 analysts covering TSM stock, 10 recommend “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average TSM stock price target is $337.75, above the current price of $268.83.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Meta Platforms Just Lost Its Chief AI Scientist. Does That Make META Stock a Sell Here?

- Eli Lilly Stock Joins the $1 Trillion Club as LLY Hits New All-Time Highs

- Is Archer Aviation Stock a Buy on New Powertrain Supply Deal?

- This 1 Company Is the Nvidia of Quantum Computing. Should You Buy Its Stock Now?